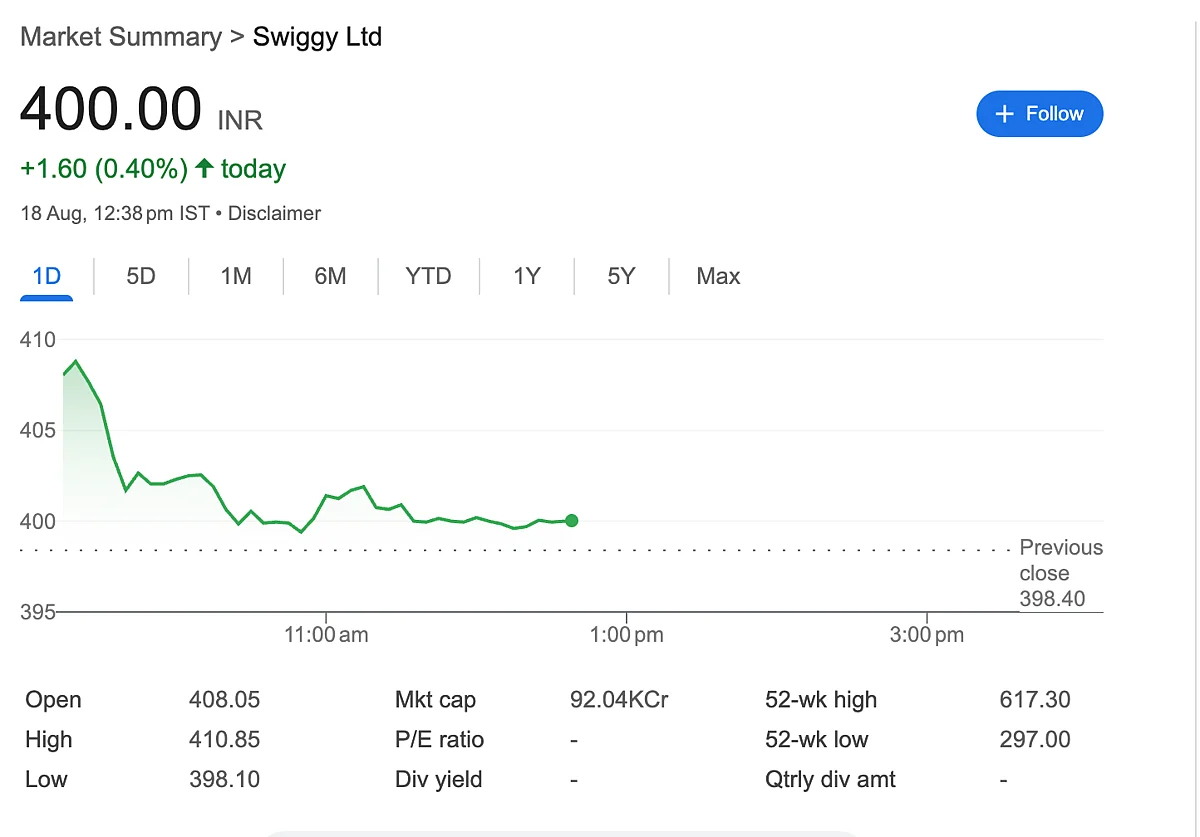

New Delhi: Shares of Swiggy Ltd saw strong buying activity on Monday, rising 2.7 percent to Rs 410. On Thursday, the stock had closed at Rs 398. The rally came after the company announced a hike in its platform fee on food delivery orders.

Swiggy said it has increased the platform fee from Rs 12 to Rs 14, though this hike will only apply to select regions where the order volumes are the highest.

Why the Fee Hike Matters

The move is expected to help Swiggy reduce its widening losses. In the June quarter (ended June 30, 2025), the company reported a net loss of Rs 1,197 crore, more than double compared to the same period last year.

By raising platform charges, Swiggy hopes to improve its financial position and move towards profitability.

Revenue Growth Despite Losses

Interestingly, the company showed strong revenue growth during the same quarter. Operating revenue rose 54 percent year-on-year to Rs 4,961 crore, mainly driven by higher order volumes. This indicates strong demand for online food delivery despite rising costs.

Stock Performance in 2025

Swiggy’s stock performance this year has been mixed:

2025 YTD: Down 26 percent overall

6 months: Up 17 percent

3 months: Gained 29 percent

1 month: Only a marginal 1 percent rise

This shows that while the stock has given good short-term returns, it still lags behind on a yearly basis.

Investor Outlook

Analysts believe the platform fee hike could improve margins and reduce losses over time. However, investors are cautious as the company still faces high competition and growing operating costs.

Disclaimer: This article is for information purposes only. It should not be considered as investment advice. Please consult a certified financial advisor before making investment decisions.