New Delhi, Sep 3: In a significant development for policyholders, GST on individual health and life insurance premiums, which currently stands at 18 per cent, has been reduced to nil in the 56th GST Council meeting, and will come into effect starting September 22.

Insurance Becomes More Affordable

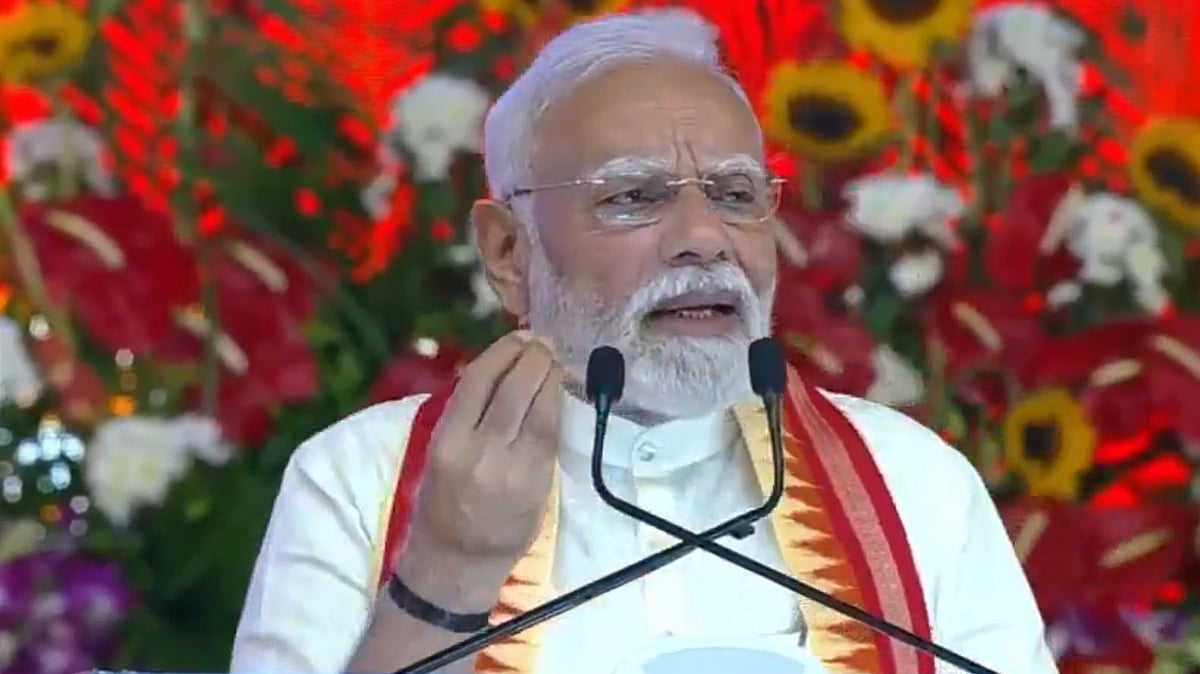

Finance Minister Nirmala Sitharaman said the move will make insurance more affordable for the common man and help expand coverage across the country.

Exemption Covers All Major Policies

Moving forward, all individual ULIP plans, family floater plans, and term plans will be exempt from GST. Currently, insurance services attract 18 per cent GST.

Relief for Life Insurance Products

With this change, all individual life insurance policies — including term life, Unit Linked Insurance Plan (ULIPs) and endowment plans — as well as their reinsurance, will now fall under the nil GST category.

Health Insurance Policies Also Exempted

The exemption also extends to all individual health insurance policies, including family floater and senior citizen plans, along with their reinsurance.

For example, if a policyholder pays Rs 100 as a premium towards buying an insurance policy, he or she actually ends up making a payment of Rs 118 (Rs 100+ Rs 18 GST).

Premium Payments to Become Cheaper

With the exemption, customers will now pay only the base premium quoted by insurers, with no additional GST. Industry experts say this could cut the effective cost of policies by around 15 per cent, making them more accessible and boosting insurance penetration in the country.

Also Watch:

Part of Wider GST Overhaul

In a landmark move, the GST Council, chaired by Finance Minister Sitharaman, on Wednesday rationalised the indirect tax structure, cutting the current four slabs down to two -- scrapping the 12 per cent and 28 per cent rates, while retaining the 5 per cent and 18 per cent slabs.

The changes in GST rates on services will be implemented from September 22.

(Disclaimer: Except for the headline, this article has not been edited by FPJ's editorial team and is auto-generated from an agency feed.)