The RBI governor announced today that the Jan Dhan account scheme had completed 10 years and a large number of accounts had become due for re-KYC. Consequently, public sector banks are organising camps for re-KYC of Jan Dhan scheme accountholders at the panchayat level from July 1 to September 30, 2025, at the consumer doorstep. According to the Economic Times, the camps will also focus on micro insurance and pension schemes for financial inclusion and customer grievance redress.

What Is The Process For Re-KYC?

Re-KYC (Periodic Updation of Know Your Customer) is a simple process where you can update your personal and address details to keep your records up to date with the bank where you hold accounts. If your KYC is due for renewal or if any details have changed, you should provide updated information to stay compliant with regulations.

Pradhan Mantri Jan-Dhan Yojana

Pradhan Mantri Jan-Dhan Yojana (PMJDY) is a national mission for financial inclusion to ensure access to financial services, namely, basic savings and deposit accounts, remittance, credit, insurance and pension in an affordable manner. Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account.

RBI

Prabhakar Kulkarni, Head Banking, NPV and Associates LLP, Chartered Accountants, says, "RBI has declared certain measures for depositors as well, which will help them resolve long-pending issues. These include a review of KYC guidelines for Jan Dhan Yojana account holders, marking the scheme's successful completion of 10 years. To suit the convenience of such small depositors, the RBI has decided to lay down a policy for KYC verification by arranging general camps in rural and semi-urban areas. These camps will not only facilitate KYC verification but also promote micro insurance schemes for such deposit holders. Additionally, RBI is formulating a policy for the settlement of claims of assets kept in safe deposit lockers after their closure. Most importantly, the RBI has decided to make RBI bonds available for retail investors. These measures are clearly in the interest of small deposit holders."

Benefits of PMJDY

According to the PMJDY website, the benefits under the scheme are as follows:

One basic savings bank account is opened for an unbanked person.

There is no requirement to maintain any minimum balance in PMJDY accounts.

Interest is earned on the deposit in the PMJDY account.

Rupay Debit card is provided to the PMJDY account holder.

Accident insurance cover of Rs 1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with the RuPay card issued to the PMJDY account holders.

An overdraft (OD) facility up to Rs. 10,000 to eligible accountholders is available.

PMJDY accounts are eligible for Direct Benefit Transfer (DBT) under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), and Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

PM Modi's Statement

Sharing an important update with the public, PM Modi on August 2, 2025, said, “Under the Jan Dhan Yojana, 55 crore bank accounts have been opened for the poor across the country”. He informed that the scheme has recently completed ten years, and as per regulations, bank accounts require fresh KYC verification after ten years. He added that to fulfil this requirement, a nationwide campaign has been launched from 1st July 2025. The Prime Minister said that banks were reaching every gram panchayat, and camps have already been set up in nearly one lakh gram panchayats, while lakhs of people have completed their KYC renewal. The Prime Minister urged every individual who holds a Jan Dhan account to ensure they complete their KYC process without delay.”

Key Schemes

The prime minister further added that these camps are facilitating registrations for several key schemes, including the Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Atal Pension Yojana. He encouraged those who have not yet enrolled in these schemes to register and also complete the KYC process for their Jan Dhan accounts.

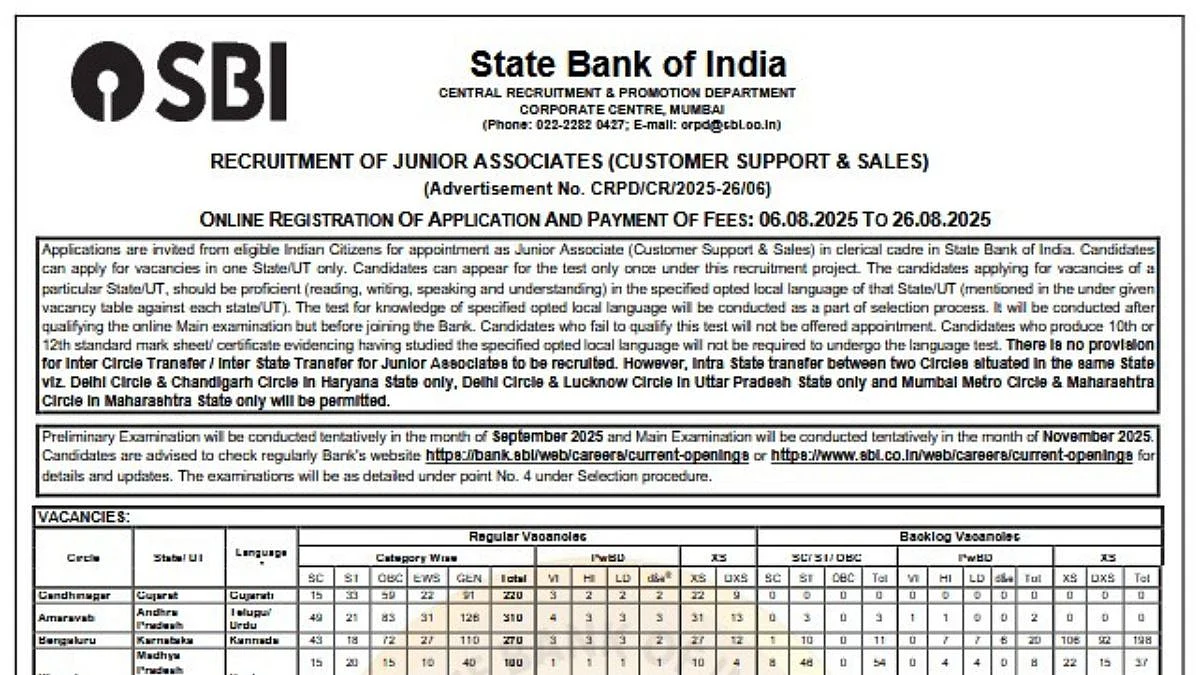

How to update the KYC in SBI

How to do re-KYC in SBI for regular and Jan Dhan accounts

You can update your KYC through SBI's internet banking:

Step 1: Log in to SBI net banking

Step 2: Click the My Accounts & Profile tab

Step 3: Select Update KYC

Step 4: Enter your profile password and click Submit

Step 5: Select your account from the drop-down menu and click Submit

Step 6: Fill out the information, upload relevant and fresh documents in case of any change and submit.

Enter the OTP sent to your registered mobile number to update your KYC.

Customers must visit the branch with their original KYC documents and one photo to update the most recent KYC documents associated with their account if there is any difference between the documents they currently have and the ones they previously submitted, or if the bank needs additional information or documentation for any other reason. One needs to fill the Annexure C-Self Declaration form for KYC updation if there is any address change, along with other documents.

How to update KYC in PNB

Here are some ways to update KYC for a Pradhan Mantri Jan Dhan Yojana (PMJDY) account in PNB:

Use digital channels: Banks can use ATMs, mobile banking, internet banking, and other digital channels to perform re-KYC.

Use OTP-based eKYC: PNB offers an OTP-based eKYC service.

Use the instant video KYC option: PNB offers an instant video KYC option