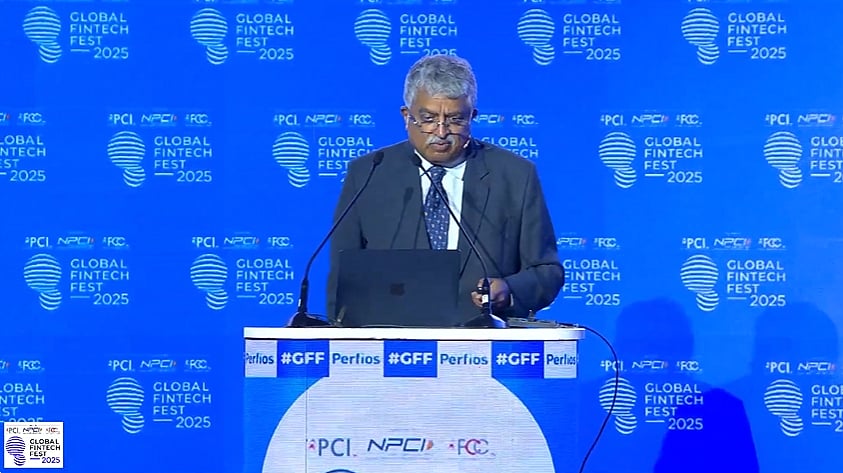

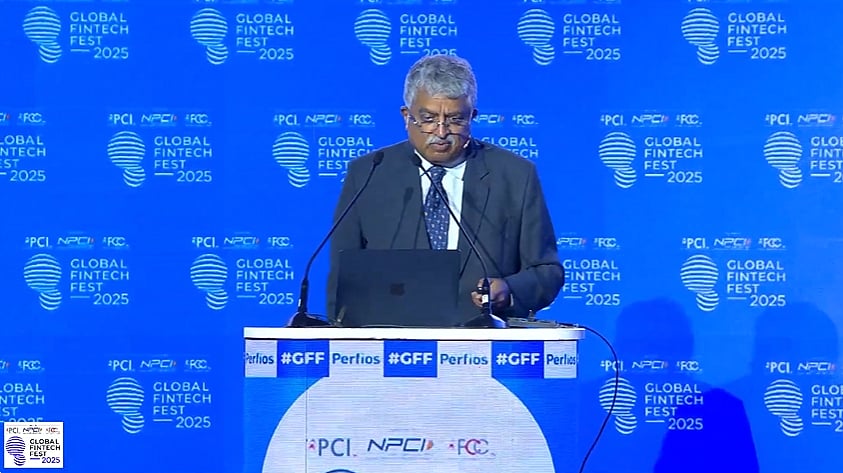

Infosys Chairman Nandan Nilekani celebrated India’s unprecedented digital leap, declaring, “India was able to achieve in nine years what would have taken 47 years under normal circumstances,” during his address at the Global Fintech Fest (GFF) 2025. Speaking at the Jio World Centre in a session titled ‘Finternet - Building the Digital Infrastructure for the World,’ Nilekani credited the Jan Dhan Yojana and India’s digital public infrastructure (DPI) for this acceleration, positioning the nation as a global leader in financial inclusion and innovation.

Highlighting the collaborative ecosystem driving this progress, Nilekani stated, “What you’re seeing is technology, government, Reserve Bank of India (RBI) and National Payments Corporation of India (NPCI), and all the private innovators working together to achieve this.” He shared striking data points to underscore India’s digital prowess: 1.43 billion Aadhaar holders, 2.4 billion eKYC transactions, 600 million DigiLocker users, 780+ institutions on the Account Aggregator (AA) system with over 5 billion cumulative data shares, and NPCI’s UPI processing $9.24 billion daily through 20 billion monthly transactions across 688 banks.

Nilekani spotlighted his passion project, Finternet, describing it as “India’s ambitious vision to build a global digital infrastructure that integrates tokenisation, artificial intelligence (AI), and regulated financial systems.” He emphasised its potential to transform asset management, stating, “Any asset, from gold and property to securities, could be digitised, verified, and transacted programmatically within a fully regulated framework, enabling ordinary citizens to leverage their wealth, access credit, and participate in new economic opportunities.” With Finternet expanding across 20 ecosystems in four continents and live implementations expected by 2026, Nilekani projected a future where tokenised assets and smart contracts deliver scalable value globally.

Inclusion remained a core theme, with Nilekani advocating for broader participation through localised solutions. “We have a wide set of leaders across industries willing to participate. We have to become even more inclusive. Language is going to be a big part of that. The combination of agentic AI with local language will really take inclusion to the next level,” he said. He also highlighted the AA system’s potential to deliver instant loans to informal workers, noting, “The expansion of AA system to give even a vegetable vendors loan instantly. All of those goals are within reach.”

Addressing global connectivity, Nilekani emphasised cost-efficient cross-border payments and asset tokenisation, stating, “India is now improving cross-border payments and planning global adoption of digital assets, making the Indian digital ecosystem more connected with the world.” He also called for reduced remittance costs, aligning with RBI Governor Sanjay Malhotra’s focus on interoperability to enable faster transactions, as discussed earlier at GFF.

GFF 2025 event continues tomorrow with keynotes from Prime Minister Narendra Modi and UK Prime Minister Keir Starmer, focusing on AI-driven global fintech collaborations