A personal loan lets you manage short-term financial needs without dipping your savings or relying on informal sources. Whether it’s covering medical expenses, funding a trip, or handling urgent home repairs, a ₹65,000 loan can provide timely relief. NBFCs like Upwards offer unsecured personal loans tailored to salaried professionals across India. Its streamlined process and minimal documentation make it a practical choice for those seeking quick financial support.

Why Choose Upwards for a ₹65,000 Loan?

Upwards Personal Loan is designed to meet the needs of salaried individuals seeking quick, unsecured credit. Upwards stands out for its accessibility, speed, and user-friendly process. Available in over 200 cities, Upwards Personal Loan services are accessible via mobile app and website, ensuring convenience.

Key advantages include:

● Quick approval: Usually within 24 hours

● Fast disbursal: Funds released in 2–5 working days

● No collateral: No asset pledge required

● Affordable rates: Interest rates start at 9% p.a.

● Simple eligibility: ₹20,000 monthly income and CIBIL score of 650+

● Flexible tenures: Repayment tenures of up to 60 months

● Digital process: Fully paperless application

● Quick support: In-app and WhatsApp assistance available for all loan related queries

Eligibility Criteria

To apply for a ₹65,000 personal loan from Upwards, you must:

● Be an Indian citizen aged between 21–55 years

● Be a salaried employee earning at least ₹20,000 per month

● Have 6+ months experience in the current job

● Have 2+ years of total work experience

● Preferably hold a CIBIL score of 650 or above

Meeting these criteria improves the approval chances and may lead to better loan terms.

Required Documents

Upwards requires a few standard documents to verify identity, income, and address. These documents are essential for processing the loan application and ensuring compliance with regulatory norms:

● PAN Card – For identity and credit check

● Aadhaar Card – For identity and address verification

● Last 3 Salary Slips – For income and employment verification

● Last 3 Months’ Bank Statements – For salary credit and financial behaviour verification

All documents must be uploaded digitally during the application process. You should ensure that scanned copies are clear, legible, and up to date to avoid delays or rejections.

Application Process

The application process to get ₹65,000 loan via Upwards is designed to be user-friendly and efficient. It is quick, fully digital and requires no physical paperwork. Here are the steps for application:

1. Download the Upwards app or visit the website

2. Sign-in using Gmail or Facebook

3. Enter personal and employment details

4. Complete KYC with PAN, Aadhaar details

5. Upload required documents

6. Provide bank account details

Post approval, loan disbursal occurs within 2–5 working days. It is advised to keep all documents ready and ensure accuracy in the information provided to avoid delays.

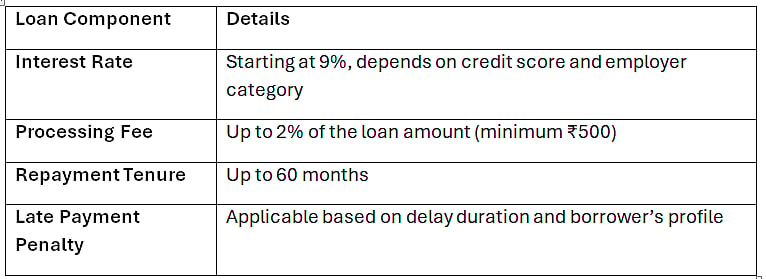

Loan Terms and Charges

Upwards offers flexible terms based on your credit profile and income level. For a ₹65,000 personal loan, the following terms typically apply:

The exact EMI and charges are shown before final approval, allowing you to make informed decisions. There are no charges for applying, and you can repay early with minimal foreclosure fees.

Common Use Cases for ₹65,000 Loan

A ₹65,000 personal loan can be used for various purposes. Since the loan is unsecured, there are no restrictions on how the funds are utilised:

● Medical emergencies – Hospital bills or urgent treatments

● Education expenses – Coaching fees or short-term courses

● Home repairs – Plumbing, electrical fixes, or renovations

● Travel – Flight tickets and hotel bookings

● Weddings – Attire, gifts, or venue deposits

● Debt consolidation – Combine debts into one EMI

Make sure to use the loan responsibly and ensure timely repayment to maintain a healthy credit score and avoid penalties.

Tips to Improve Loan Approval Chances

While Upwards has a flexible approval process, you can improve your chances by following these practical tips:

● Maintain a credit score of above 650.

● Ensure accurate documentation to avoid verification delays.

● Avoid multiple loan applications as it can lower your credit score.

● Provide correct employment details to avoid rejection.

These steps help reduce the risk of rejection and ensure faster disbursal of the ₹65,000 personal loan.

Conclusion

Upwards Personal Loan offers a reliable and efficient way to access ₹65,000. With a simple digital process, minimal documentation, and flexible eligibility, it is well-suited for salaried individuals across India. Whether the need is urgent or planned, Upwards provides a practical solution with quick disbursal and transparent terms.