New Delhi: Starting September 22, GST on services like salons, barbers, gyms, fitness centers, and yoga studios will be reduced from 18 percent with Input Tax Credit (ITC) to 5 percent without ITC. This change aims to make beauty and wellness services more affordable for everyone.

Daily Products Also Get Cheaper

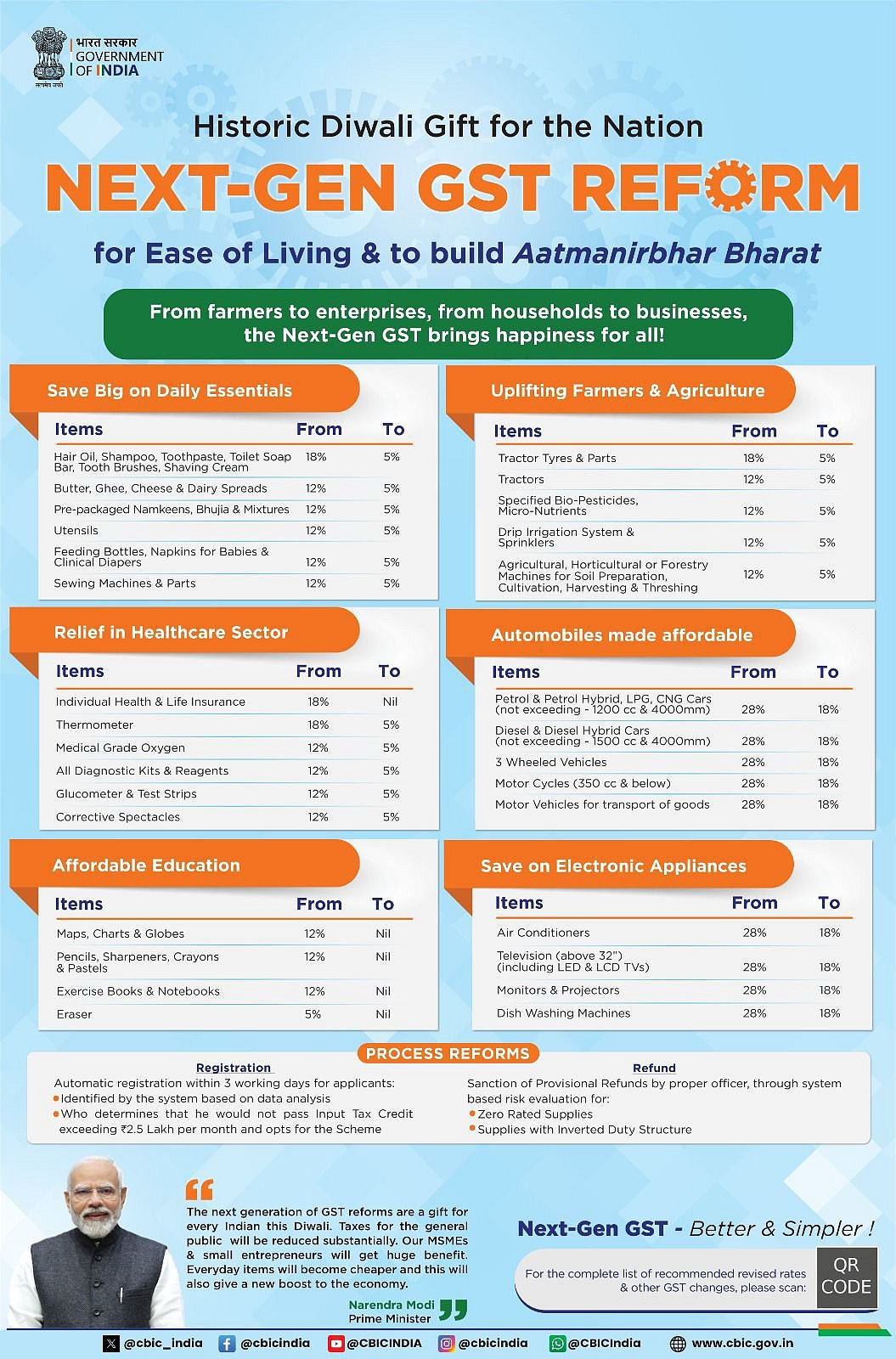

Many everyday items will now attract just 5 percent GST, down from 12 percent or 18 percent. These include hair oil, shampoo, toilet soap bars, toothbrushes, toothpaste, talcum powder, face powder, shaving cream, and aftershave lotion.

However, liquid soaps and mouthwash remain taxed at 18 percent, as only toilet soap bars and essential dental hygiene products have been included in the reduction.

Simplifying Tax Without Complexity

The Finance Ministry explained that while luxury cosmetics will benefit too, setting different tax rates based on brand or price would add unnecessary complexity. The aim is to simplify GST and ensure ease of administration.

Will Providers Pass on Savings?

While cheaper taxes seem consumer-friendly, the removal of ITC means businesses can’t offset their input costs-rent, consumables, maintenance-against tax. As a result, providers may partially pass on these costs in service prices, which could dilute consumer savings.

According to PTI, AMRG & Associates’ Senior Partner Rajat Mohan noted that this GST rationalisation is meant to reposition personal care and wellness on par with essential services, not luxuries. Yet he cautioned that without strong oversight-particularly from bodies like the Anti-Profiteering Authority-there's uncertainty about how much of the tax benefit will actually trickle down to consumers.