New Delhi: The Indian stock market is expected to take direction from global events, foreign investor activity, and important economic data in the coming week, analysts said. The week will also be shorter for trading as markets will remain closed on Wednesday for Ganesh Chaturthi.

Fed rate cut hopes boost global sentiment

Markets across the world turned positive after US Federal Reserve Chair Jerome Powell hinted at possible interest rate cuts during his speech at the Jackson Hole Symposium. This triggered a strong rally in US stocks on Friday, with the Dow Jones rising nearly 2 per cent, while the Nasdaq and S&P 500 also gained sharply.

A weaker dollar index further added to optimism, which could support flows into emerging markets like India.

Tariff concerns remain a key risk

One of the biggest concerns for investors is the August 27 deadline for the US decision on imposing additional tariffs on Indian goods. The US has already doubled tariffs on certain Indian products to 50 per cent, adding a 25 per cent duty linked to India’s purchase of Russian crude oil.

Analysts say the lack of clarity may keep foreign institutional investors (FIIs) cautious in the coming days

Domestic factors to watch

Apart from global cues, investors will also keep a close eye on India’s own macroeconomic indicators. Data on Index of Industrial Production (IIP) and Gross Domestic Product (GDP) will be released this week, giving a clear picture of the country’s economic momentum.

Experts believe optimism around GST 2.0 reforms and strong domestic fundamentals may continue to support equities despite global uncertainties.

Recent performance

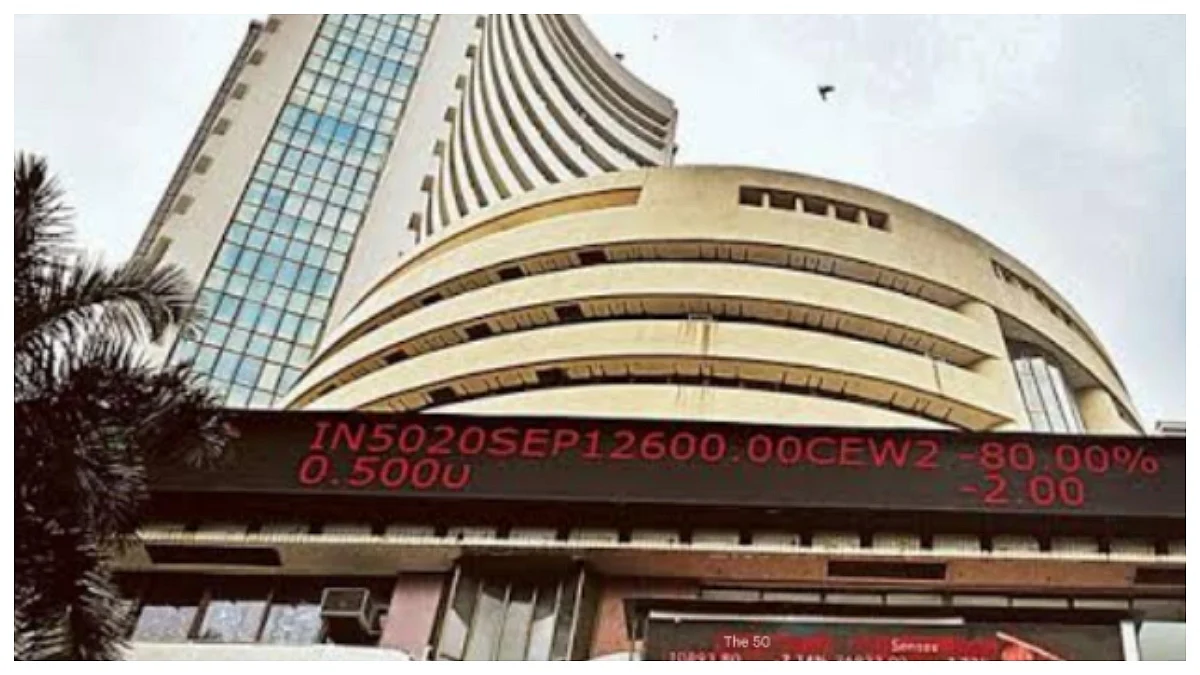

Last week, the BSE Sensex gained 709 points (0.87 per cent), while the Nifty 50 climbed nearly 239 points (0.96 per cent), driven by positive investor sentiment.