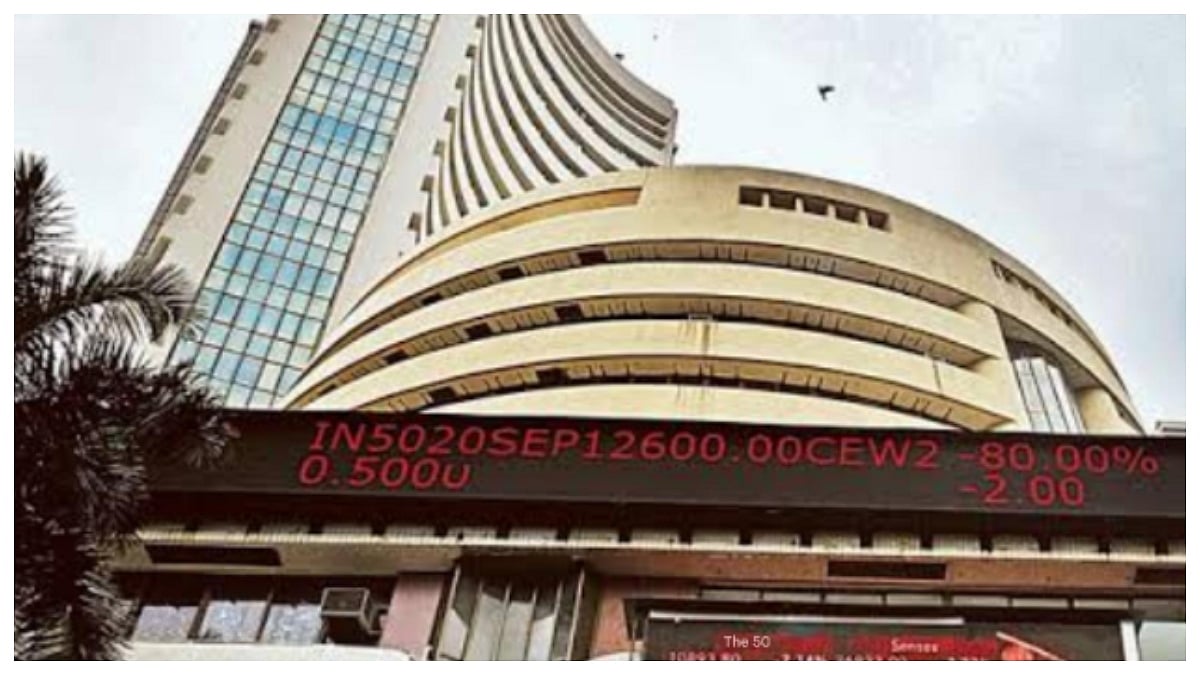

Mumbai: On Friday, Indian equity markets faced a sharp downturn after a six-day rally fueled by hopes of GST reforms and a possible S&P sovereign rating upgrade. The BSE Sensex fell 693.86 points (0.85 percent) to close at 81,306.85, while the NSE Nifty dropped 213.65 points (0.85 percent) to 24,870.10.

Sector-Wide Sell-off

Among Sensex’s 30 constituents, ICICI Bank, Adani Ports, HCL Tech, Eicher, and Asian Paints took the biggest hit, each losing between 0.6 percent to 0.8 percent. The financial sector index slipped 0.4 percent, with the banking index down 0.3 percent. Reliance Industries, Nifty’s third-largest stock, also dropped 0.7 percent. Meanwhile, mid-cap stocks edged up 0.2 percent, and small caps remained largely flat.

Tariff Threats Shake Investor Sentiment

Dr. V.K. Vijaykumar, Chief Investment Strategist at Geojit, cited looming 25 percent US tariffs under Trump as a trigger for today’s decline. These tariffs risk dampening India’s growth outlook, particularly if applied in August. He noted that large-cap stocks continue to outperform, with Nifty up ~1 percent over the year, while mid-cap and small-cap indices remain deep in the red.

Global Caution Ahead of Powell's Speech

Asian markets opened cautiously as investors awaited a key speech by Federal Reserve Chair Jerome Powell at Jackson Hole. His address could reveal whether the Fed plans to cut interest rates in September, influencing global markets. Fed guidance remains critical amid mixed US economic signals.

The sharp fall underscores a fragile sentiment: domestic optimism around GST reforms and rating upgrades is easily overshadowed by global risks like protectionist tariffs and uncertain central bank policy. For sustained gains, markets need a better balance between domestic growth cues and global stability.