Key Highlights:

- Rajiv Singh received Rs 36.65 crore in FY24-25, with Rs 34.53 crore as commission.

- DLF reported record sales bookings of Rs 21,223 crore and a 60 percent rise in net profit.

- Managing Directors Tyagi and Devinder Singh earned Rs 14.16 crore each, with modest hikes.

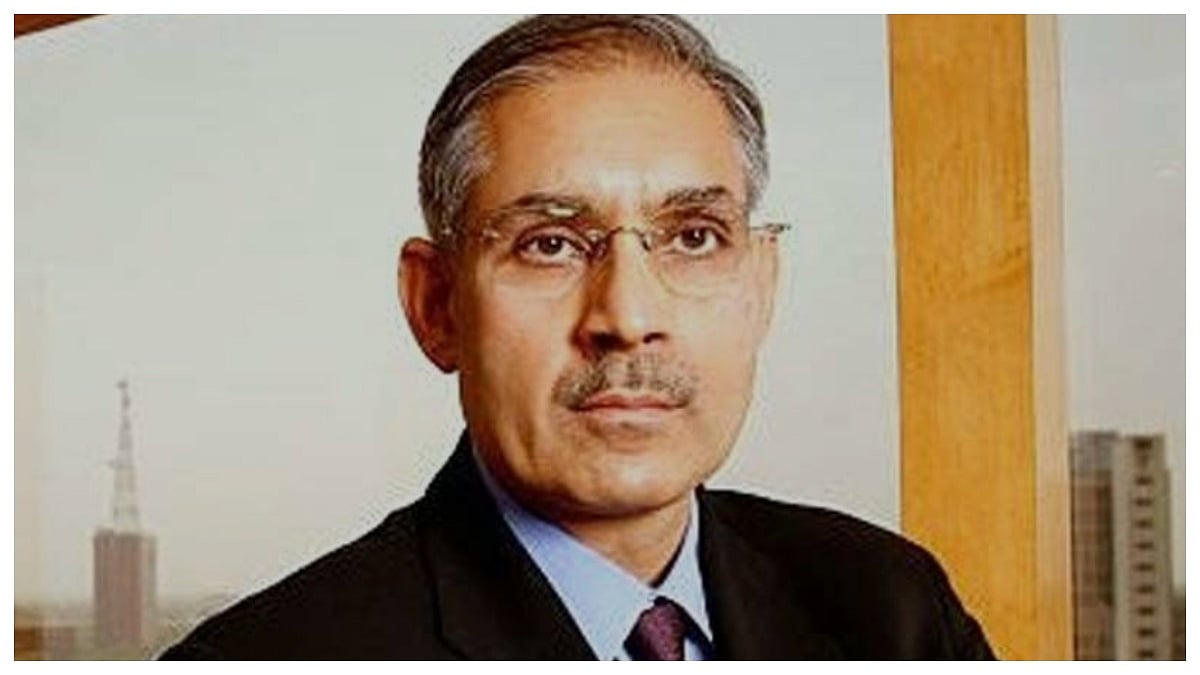

Mumbai: Rajiv Singh, Chairman and Whole-Time Director of DLF, India’s largest real estate company by market capitalisation, received a 34 percent hike in remuneration, earning Rs 36.65 crore in the financial year 2024–25. The rise in pay reflects DLF’s strong financial and operational performance.

Out of the total package, a significant portion—Rs 34.53 crore—was paid as commission/variable pay, linked to key performance metrics such as consolidated profit after tax, cash flows, construction expenditure, and pre-sales.

Managing Directors Also Receive Incentive-Based Compensation

Alongside the Chairman, Managing Directors Ashok Kumar Tyagi and Devinder Singh received Rs 14.16 crore each as total remuneration for FY24-25, compared to Rs 13.52 crore in the previous fiscal, marking an increase of around 5 percent. Both assumed their roles as Managing Directors on August 4, 2023.

For both Tyagi and Singh, Rs 8.77 crore of the remuneration came as commission, approved by the board based on the achievement of defined business goals.

Strong Financials Underpin Pay Hikes

DLF delivered robust financial performance in FY24-25:

Net profit surged to Rs 4,366.82 crore, up from Rs 2,723.53 crore in the previous year.

Total income rose to Rs 8,995.89 crore, a healthy jump from Rs 6,958.34 crore.

Sales bookings hit a record Rs 21,223 crore, marking a 44 percent increase from the prior fiscal.

For FY25-26, DLF has set an ambitious sales target of Rs 20,000–22,000 crore in housing.

Expanding Footprint and Future Pipeline

Since inception, DLF has developed over 185 projects across 352 million sq. ft. of area. It holds 280 million sq. ft. of development potential across residential and commercial segments, including projects under execution.

The group also has a 45 million sq. ft. annuity portfolio, supporting steady rental income across its commercial ventures.

(With PTI Inputs)