Running a business today means thinking fast, adapting faster, and investing smartly. Whether you're managing a growing enterprise or expanding a current one, the need for funds is constant—expanding operations, upgrading machinery, or even building infrastructure all come with a cost.

But here’s the challenge: conventional loans involve long paperwork, unpredictable processing times, and often, rigid terms. For entrepreneurs with tight schedules and tighter margins, these delays can cost valuable opportunities.

To address this common roadblock, Bajaj Finance offers business loan that empowers business owners to act swiftly. With loan amounts ranging from Rs. 2 lakh to Rs. 80 lakh, it is a great option for businesses of all scales.

Why Bajaj Finserv Business Loan is an option to consider

Bajaj Finserv Business Loan helps businesses swiftly meet their financial needs. Whether it’s for purchasing equipment, expanding premises, or managing working capital, this loan offers quick, convenient, and practical support. Here are some important features to consider:

• Loan amount up to Rs. 80 lakh: Get the funding you need for big or small projects

• Flexible tenure: Choose repayment terms between 12 and 96 months

• Quick disbursal: Get funds in your account, often within 48 hours*

• No collateral required: No need to pledge assets for higher loan eligibility

In case you are looking for a higher loan amount for your business, Bajaj Finance also offers the option of a secured business loan of up to Rs. 1.05 crore, which involves pledging an asset to access greater funding capacity.

Bonus alert: Cashback with Loan Utsav

Here’s where it gets even better. Bajaj Finance is running a limited-period ‘Loan Utsav’ campaign that rewards early loan applicants with cashbacks and other rewards (in the form of vouchers).

If you apply and receive a loan disbursal during June or July 2025 via the Bajaj Finserv App, and you’re among the first 200 successful disbursals in the month, you’re eligible for up to Rs. 3,000 cashback.

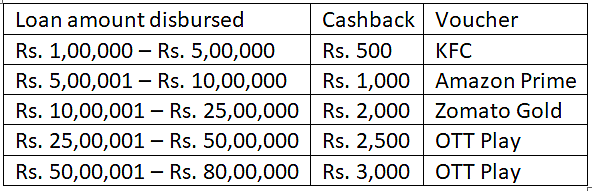

Here is the reward structure based on the loan amount disbursed:

To unlock these benefits, applicants must complete their application and disbursal via the Bajaj Finserv App and activate their Bajaj Pay Wallet within 90 days. Those who don’t activate their wallet will receive the rewards as Bajaj Coins, which can still be redeemed for vouchers and services within the app.

How to apply on the Bajaj Finserv App

Based on eligibility, you can follow these simple steps to apply for a Bajaj Finserv Business Loan and avail of the Loan Utsav rewards:

● Download the Bajaj Finserv App from the Google Play Store.

● Log in using your mobile number.

● On the home screen, tap the “Business Loan” icon.

● Click on the “CHECK ELIGIBILITY” button.

● Fill out the application form with your basic personal and professional details.

● Once completed, tap “CONTINUE”.

● Enter your banking details as requested.

● Finally, submit your application for processing.

This combination of speed, scale, flexibility, and cashback makes Loan Utsav one of the best times to apply for funding.

For any entrepreneur looking to fund their next big leap, Bajaj Finserv Business Loan is a reliable partner. With rewards under the Loan Utsav campaign, business owners not only get the money they need—but also a little something extra. So, why wait? Apply now.

*Terms and conditions apply