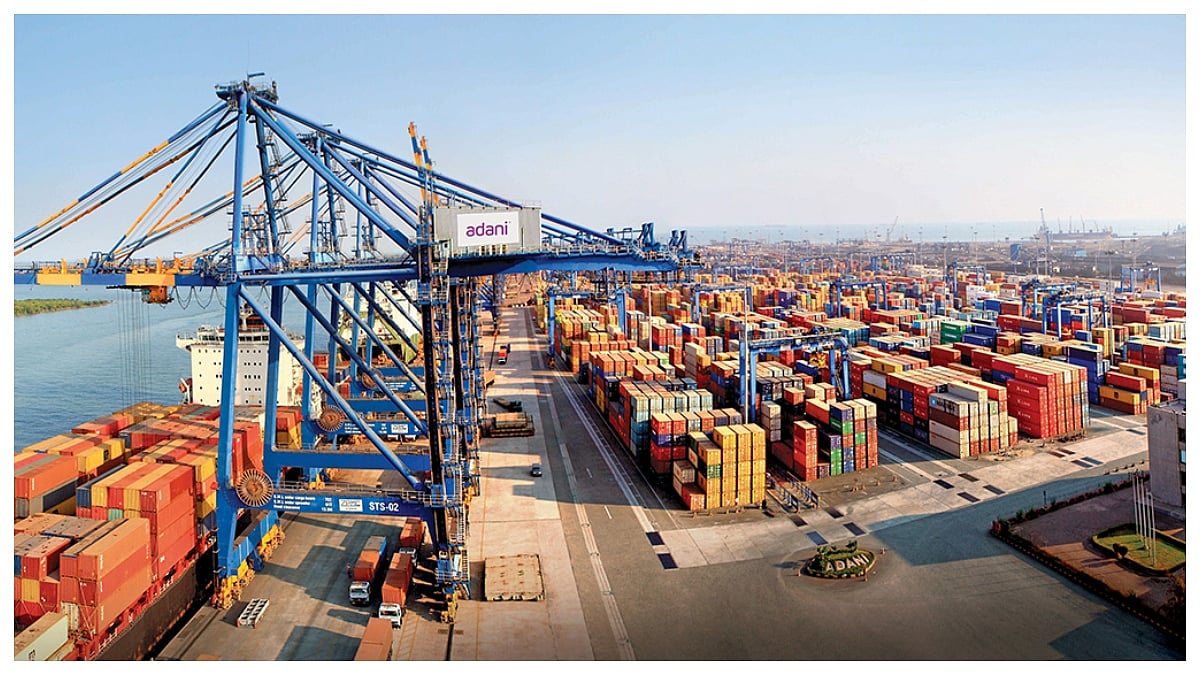

Adani Ports Reports Strong Q1 With 21% Revenue Growth, Logistics & Marine Businesses Lead The Surge

Adani Ports posted a 21 percent YoY revenue jump in Q1 FY26, driven by a strong performance in logistics and marine segments. Operational expansion and international growth supported healthy profitability and outlook.

Adani Ports Posts Strong Q1 FY26 Performance. |

Key Highlights:

- Revenue up 21 percent YoY to Rs 9,126 crore; PAT at Rs 3,311 crore

- Logistics and marine revenues soared 2x and 2.9x respectively

- Strong international performance with Haifa port revenue and EBITDA at all-time highs

Ahmedabad: Adani Ports and Special Economic Zone Ltd (APSEZ) reported solid results for the quarter ending June 30, 2025 (Q1 FY26), with total revenue rising 21 percent YoY to Rs 9,126 crore, driven by explosive growth in logistics and marine segments.

Profitability and EBITDA Remain Strong

EBITDA rose 13 percent YoY to Rs 5,495 crore, despite a change in business mix, with newer verticals offering higher RoCE but lower margins.

Profit After Tax (PAT) stood at Rs 3,311 crore, up 7 percent YoY.

Last year’s PAT included a Rs 141 crore dividend from a JV, now expected in Q2.

ALSO READ

Strategic Milestones

Colombo West International Terminal (CWIT) began operations. Once fully operational, it will handle 3.2 million TEUs annually.

Dhamra Port expanded with a new export berth and two under-construction berths to increase capacity to 92 MMT.

Vizhinjam Port completed its first year with full utilization in its ninth month and has started Phase 2 construction.

NQXT Port in Australia approved for acquisition, pending regulatory clearance.

Operational Performance

Handled 121 MMT cargo volume, up 11 percent YoY. Container volumes rose 19 percent YoY.

Haifa Port in Israel posted 29 percent YoY growth in volumes, highest revenue and EBITDA since acquisition.

Krishnapatnam Port handled its highest ever monthly cargo in June 2025.

Mundra Port achieved India’s highest single-day TEU handling at 3,234.

Financial and Debt Management

Domestic ports contributed Rs 6,137 crore in revenue (up 14 percent), with EBITDA margin of 74.6 percent.

Issued Rs 5,000 crore in 15-year NCDs to LIC, helping extend average debt maturity to 5.2 years and reducing bond yields by up to 116 bps.

Net debt to EBITDA stood at a healthy 1.8x, with Rs 16,921 crore in cash balance.

ESG Progress and Recognition

APSEZ maintained strong ESG ratings from CRISIL, ISS, NSE, and SES.

12 ports certified Zero Waste to Landfill.

Deployed electric-powered mobile cranes and built India’s first steel slag road within a port.

RECENT STORIES

-

-

-

-

-