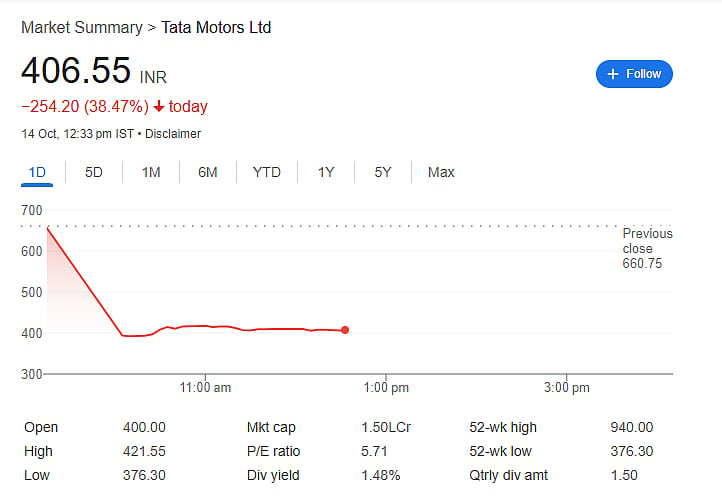

Mumbai: On Tuesday, Tata Motors shares saw a sharp 40 percent drop in early trade. The stock opened at Rs 399 on the BSE, compared to its closing price of Rs 660.90 on Monday. This steep fall followed the company’s official demerger of its commercial vehicle and passenger vehicle businesses.

Although the drop may seem alarming, market experts say it is due to the technical adjustment after the business split and won’t affect investors' actual holdings.

Company Now Split Into Two Entities

Tata Motors has now officially split into two companies. The record date for the demerger was October 14, 2025. Based on this, eligible shareholders will receive shares in a new company named Tata Motors Commercial Vehicles Ltd (TMLCV).

The original company will now focus only on passenger vehicles and Jaguar Land Rover (JLR) and has been renamed Tata Motors Passenger Vehicles Ltd (TMPVL).

Share Distribution and Listing Timeline

As part of the demerger, shareholders will receive 1 share of TMLCV for every 1 share held in Tata Motors. These new shares will be credited to investors' demat accounts within 40–45 days.

Trading of these shares on BSE and NSE will start after regulatory approvals, with some reports suggesting a possible listing by mid-November.

F&O Contracts Adjusted Post-Demerger

Following the demerger, all existing Futures & Options (F&O) contracts for October, November, and December were settled on Monday. From today, new contracts with updated lot sizes have started trading. This adjustment helps maintain market stability after such corporate actions.

Demerger Expected to Benefit Both Businesses

Brokerage firms see this demerger as a positive move for both companies. SBI Securities noted that this split will help in better valuation and focus for each business.

Since TMPVL earns 87 percent of its revenue from JLR, its share price is expected to settle between Rs 285 and Rs 384, depending on future JLR performance and profits.