Indian Markets In Decline

As anticipated, the Indian markets opened for trade on Thursday, December 19, with deep cuts. The marquee indices, including the BSE Sensex and NSE Nifty, both started the day's trade with a major decline in their cumulative value.

This is in tandem with other Asian markets, including Nikkei and Hang Seng, who themselves have fallen victim to the ripple effect that was initiated in the United States.

In a major development, the US Fed decided to further cut its interest rates by 25 basis points, taking the overall interest rates to the range of 4.25 per cent to 4.50 per cent. What followed was the collapse of the US markets, with all Dow Jones, S&P 500 and Nasdaq crumbling.

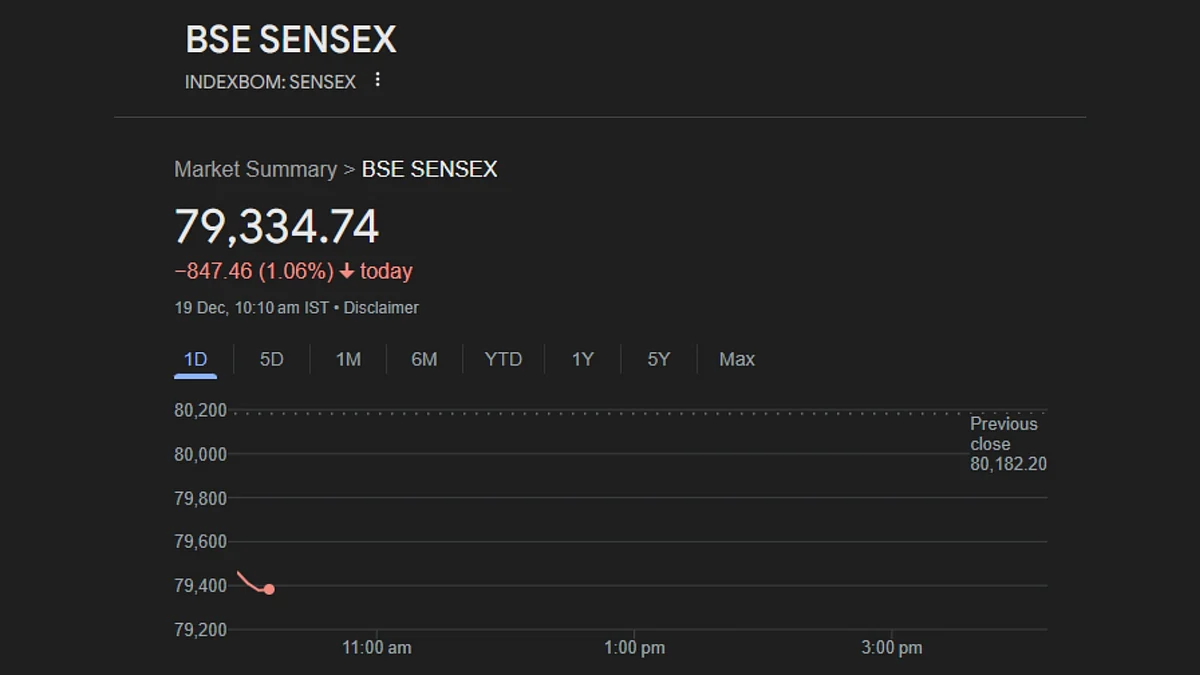

Coming to the Indian indices, the Sensex declined by over 1,000 points at the opening. The Nifty declined by over 200 points.

Sensex In Red

At the time of writing the decline aberrated a little, but the decline continued to progress. Before 10:00 IST, the BSE Sensex declined by 780.84 points or 0.97 per cent, taking the overall value to 79,401.36.

In addition, the Nifty index also dropped in value. The decline took the index to 23,982.05. Nifty fell by 216.80 points or 0.90 per cent.

When we look at the losers and the gainers, the BSE Sensex finished at red wall at the time of writing. Amongst the losers, Asian Paints, Mahindra and Mahindra, and Bajaj Finserv all lost value of over 2 per cent. When it comes to the gainers, Tata Group's TCS was trading with minor gains of under 0.30 per cent.

The Asian markets, after opening with cuts of over 1 per cent, found reasons to relax, as the ferocity of the dip subsided. The Nikkei index dropped by 0.66 per cent or 258.64 points, dipping to 38,823.07 points. The Hang Seng on the other hand also saw red, diminishing by 1.00 per cent or 198.43 points, dipping to 19,666.12.

.jpg)