Mumbai: The stock of IndusInd Bank has declined 11 per cent since March 10 following the bank's disclosure of suspected fraud and concerns over insider trading.

On March 10, the bank’s then Chief Executive Officer Sumant Kathpalia said during an analyst call that these derivative trades took place over five to seven years ago and came to light when the bank took the review of the portfolio after the RBI's accounting framework, which was identified by September and October 2024.

Soon after, the bank started an internal review in the matter and informed the regulator about it. The bank had also appointed an external agency to validate its internal findings.

On Thursday, the banks’ shares were trading at Rs 813.95 apiece, up Rs 8.80 or 1.09 per cent.

In the latest development, the Securities and Exchange Board of India (SEBI) has barred former Kathpalia and four others from dealing in the share market. SEBI said they were aware of unpublished price sensitive information about the lender's derivative trades.

IndusInd Bank's former executive director and deputy CEO, Arun Khurana, along with head of treasury operations Sushant Sourav, head of GMG operations Rohan Jathanna, and chief administrative officer of consumer banking operations Anil Marco Rao are the other officials named in the order.

The individuals have been restrained from buying, selling or dealing in securities, either directly or indirectly, in any manner until further orders, the SEBI said in an interim order.

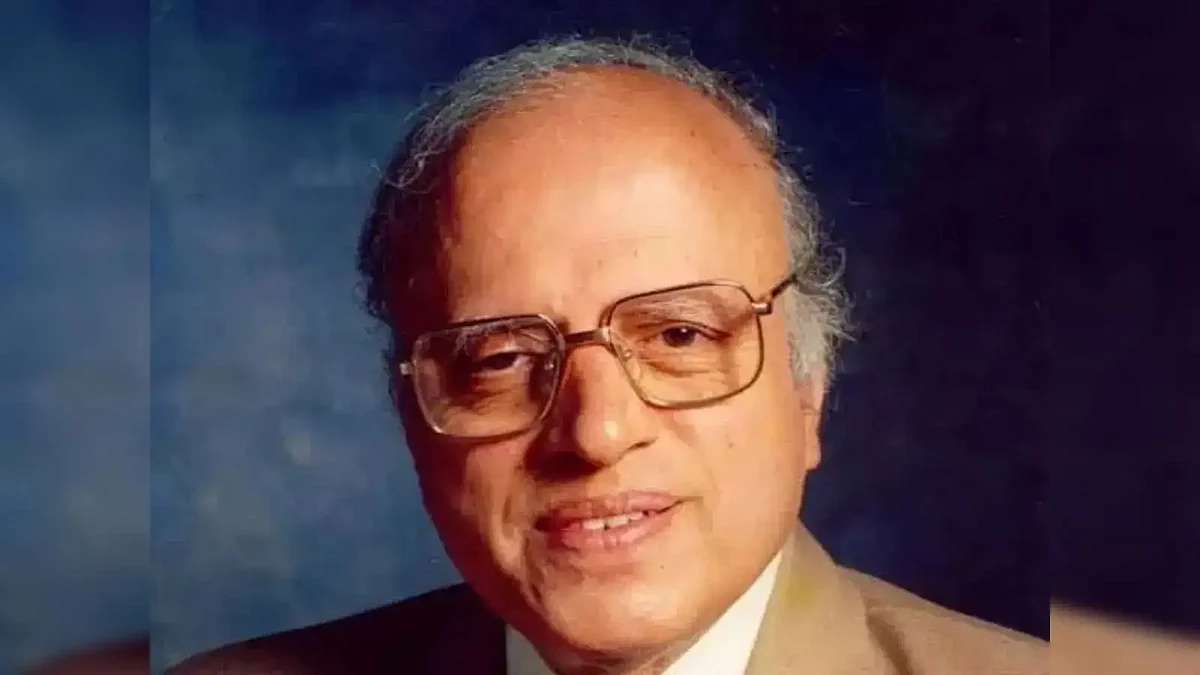

Last week, Ashok P. Hinduja, Chairman, IndusInd International Holdings Limited (IIHL) which is the promoter of IndusInd Bank, went into damage-control mode following the announcement of the fraud in the bank that has plunged the lender into a Rs 2,236 crore loss for the January-March quarter.

“Though the capital adequacy of the Bank is quite healthy, for business growth, should any further equity be required, IIHL, as the promoter of IBL, remains committed to supporting the Bank, as it has done over the past 30 years,” Hinduja said in a statement.

The RBI has launched investigations into the accounting discrepancies at IndusInd Bank.

IndusInd Bank said that its Board suspects a fraud involving certain employees, who played a significant role in the lender's accounting and financial reporting, and has directed all necessary actions to be taken under applicable laws, including reporting the matter to regulatory authorities and investigative agencies.

IndusInd Bank’s internal audit department found on May 20 that Rs 172.58 crore had been incorrectly recorded as fee income in the Microfinance (MFI) business over three quarters ending the December quarter, which has since been reversed in the fourth quarter of FY25.

The disclosure follows the abrupt sacking of the IndusInd Bank CEO last month after widespread irregularities were discovered in its foreign exchange derivatives and microfinance portfolio.

Disclaimer: This story is from the syndicated feed. Nothing has been changed except the headline.