The National Bank for Agricultural and Rural Development's (NABARD) recent study indicated that US President Trump's policies "dampened the sentiments of rural households."

Respondents reporting a decline in income was the lowest in the last 12-months but many also reported a stagnation in income.

"The percentage of households reporting a decrease in income in last one year fell to 18%, which is the lowest level recorded since the survey started first in September 2024 (Chart 2). Stagnation in income was reported by 44.5 per cent of the rural households, which is the highest among all rounds of the survey," said the report.

TRUMP's POLICY IMPACT

The study stated, "a lesser percentage of households reported expectation of an increase in income. It is possible that Trump tariff related risks for the farm and non-farm exports, and the associated impact on rural income and employment, might have dampened the sentiments of rural households expressed through this survey."

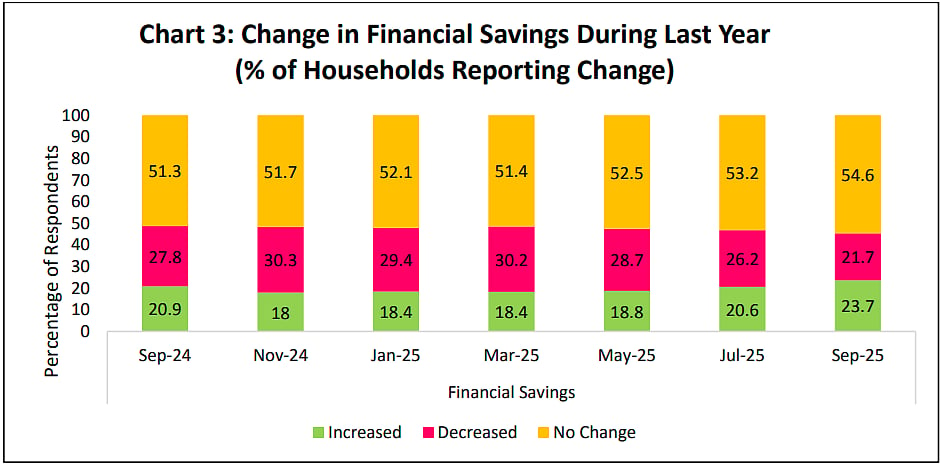

IMPACT TO FINANCIAL SAVINGS

The study also found a higher percentage of respondents stating their financial savings declining 21.7 percent as opposed to 30.2 percent in March 2025 and 27.8 percent as of September 2024.

54.6 percent respondents reported no change for September 2025 (highest in last 12-months). While those who reported an increment in financial savings stood at 23.7 percent (highest as opposed to 20.9 percent in Sept 2024).

Financial Savings of Households Reporting Change - September 2025 | Nabard Study

The data-finding from NABARD states, "In September 2025, the net response for financial savings (i.e., percentage of households reporting an increase in savings minus percentage of households reporting a decrease in savings) turned positive at 1.9 percent – the first time since the survey started in September 2024."

& WHAT ELSE?

The 24-page document holds several cues necessary to policy-making, here are five important take-aways:

1. Share of income devoted to repaying loans remained unchanged in the last three rounds of the survey.

2. Capital investment made by rural households improved, with a marginally higher percentage of them reporting an increase in investment and a lower percentage of them reporting a decrease in investment – net response accordingly improved from 6.7 percent in the July 2025 round of the survey to 8.4 percent in the September 2025 round of the survey.

3. Average Income in last one-year has reported an increase. Even for the next one year income prospects, a lesser percentage of households reported expectation of an increase in income. It is possible that Trump tariff related risks for the farm and non-farm exports, and the associated impact on rural income and employment, might have dampened the sentiments of rural households expressed through this survey.

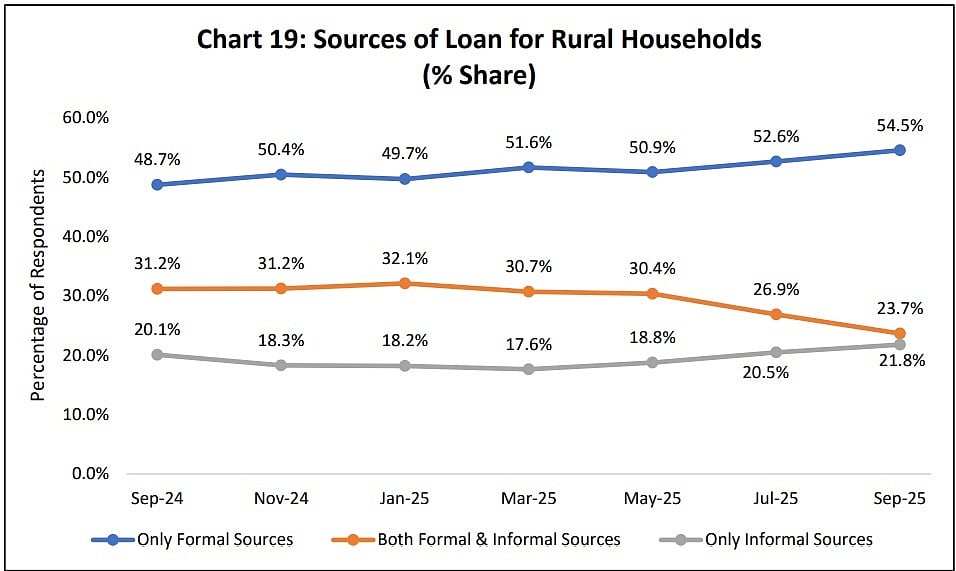

4. The share of loan from informal sources although may have declined in recent years - as per the NABARD study it stood at 21.8 percent - the highest in the last 12-months. Average interest rate paid on loans taken from informal sources too has seen an increment.

Share of Loan Sources for Rural Households in Sept 2025 | Nabard

5. While 29.8 percent were servicing an interest-free loan; 5.7 percent of respondents were paying an interest of 0-5 percent; and 12.3 percent paid interest in the range of 5-10 percent. A majority or 43.5 percent were servicing interest in the range of 15 to more than 60 percent.

WHAT DOES ALL THIS MEAN?

Government initiatives such as GST are likely to spur consumer spending. However, tariff related concerns and surprises have affected the confidence of Rural Bharat. This is another factor in addition to erratic climate and weather patterns that have already wrecked havoc in North India (natural calamities in Punjab and Dehradun).

Lower confidence in rural markets is likely to impact FMCG consumption. That in addition to Gold jewellery, of which India's rural market has usually been a big buyer.

Gold prices at astronomical highs (surpassing Rs 1.12 lakhs per ten grams), buying or investing in Gold may be a challenge for Rural India to buy given the lower confidence.