Key Highlights:

- RBI policy decision on August 6 could influence market direction.

- Q1 results of major firms like SBI, Bharti Airtel, Tata Motors expected.

- US tariffs on Indian goods add to global trade tensions.

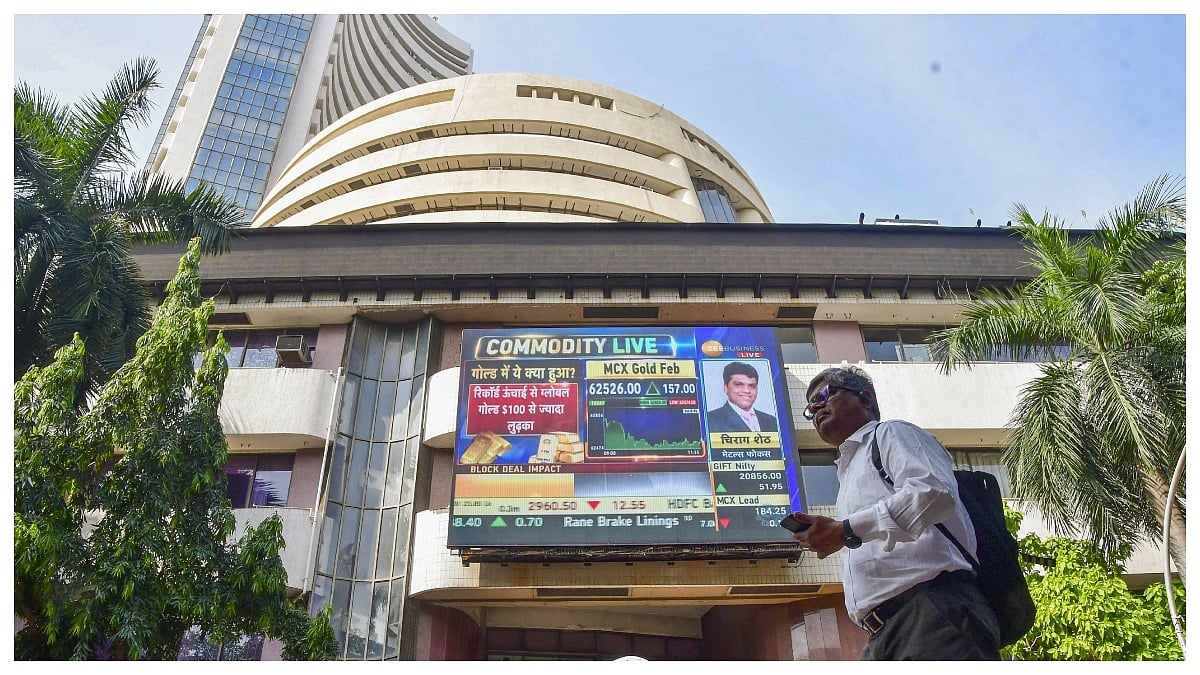

Mumbai: All eyes are on the Reserve Bank of India (RBI) this week as it prepares to announce its monetary policy decision on August 6. Market experts believe that while the central bank is expected to keep rates unchanged, its comments on inflation, growth, and liquidity will play a key role in shaping investor sentiment.

Ajit Mishra, Senior Vice President – Research at Religare Broking, said, “The RBI's outlook will be important for the markets, especially in light of global uncertainty and domestic inflation concerns.”

In addition, the release of services and composite Purchasing Managers’ Index (PMI) data for India will be closely tracked to gauge the health of the services sector.

Q1 Earnings Season to Drive Stock-Specific Action

Several big companies are set to declare their April–June quarter (Q1) earnings this week. These include Bharti Airtel, Bajaj Auto, Hero MotoCorp, Tata Motors, State Bank of India (SBI), Life Insurance Corporation (LIC), Adani Ports, Titan, Trent, and DLF.

Pravesh Gour, Senior Technical Analyst at Swastika Investmart, said, “These results will influence not just the stocks themselves but also give direction to sectors like banking, auto, telecom, and insurance.”

So far, the Q1 earnings season has been a mixed bag, adding to the cautious mood in the markets.

US Tariffs Create External Pressure

Adding to investor concerns is the surprise decision by US President Donald Trump to impose a 25% tariff on Indian goods. Additionally, penalties related to India’s trade with Russia in energy and defence sectors have created uncertainty.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, noted, “This unexpected move has impacted market sentiment in the short term. However, we expect a resolution through talks between India and the US.”

FII Outflows and Global Cues Remain in Focus

Persistent selling by foreign institutional investors (FIIs) has added to the downward pressure in recent sessions. Last week, the Sensex fell 863 points (1.05 percent), and the Nifty dropped 272 points (1.09 percent). On Friday alone, the Sensex lost nearly 586 points while the Nifty declined by over 200 points.

Siddhartha Khemka of Motilal Oswal said, “The markets are likely to stay in a consolidation phase due to mixed earnings, FII outflows, and global uncertainties.”

Investors will also keep an eye on the US and UK central banks' rate decisions and global services PMI data.

Overall, the week ahead could be turbulent for the markets. Key domestic triggers like the RBI policy and corporate results will be balanced against global worries, particularly trade tensions and FII trends.

(With PTI Inputs)