Key Highlights:

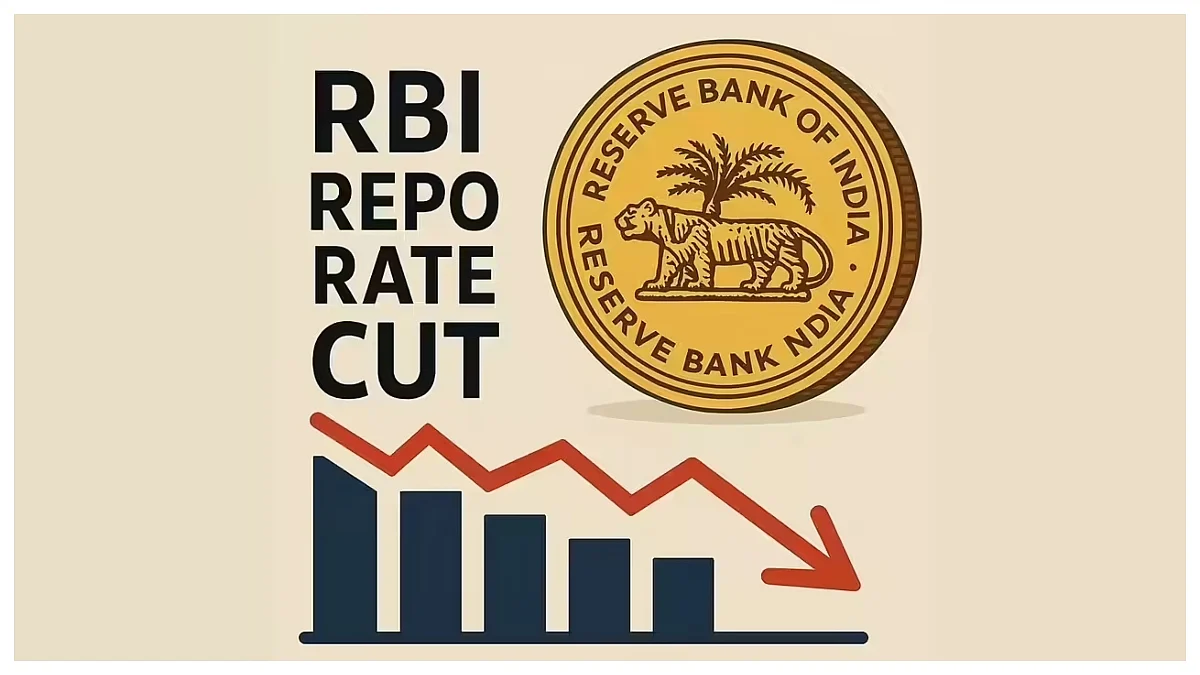

- Repo rate stays at 5.50 percent, no change in home loan EMIs

- Real estate experts say the move supports homebuyers and housing demand

- RBI maintains a cautious stance amid global uncertainties

Mumbai: The Reserve Bank of India (RBI) has decided not to change the repo rate, keeping it at 5.50 percent after its latest Monetary Policy Committee (MPC) meeting held on Wednesday.

This means that people paying home loan EMIs won’t see any increase in their monthly payments for now. The repo rate is the rate at which RBI lends money to banks. If it goes up or down, banks usually pass on the change to borrowers.

No EMI Change for Home Loan Borrowers

In its last meeting, the RBI had cut the repo rate by 50 basis points (bps), from 6 percent to 5.5 percent. With today’s decision, that rate remains the same.

Major banks like SBI, HDFC Bank, ICICI Bank, and others are currently offering home loans at interest rates between 7.3 percent and 8 percent. Experts believe that stable rates help maintain affordability, especially for first-time homebuyers and middle-income families.

Real Estate Sector Welcomes the Move

According to Prashant Sharma, President of NAREDCO Maharashtra, this decision will keep homebuyers confident and support the real estate market.

Shishir Baijal, Chairman and MD of Knight Frank India, said that stable rates give the market predictability and support housing demand, especially in affordable and mid-range homes.

Amit Goyal from India Sotheby’s International Realty added that RBI’s policy shows steady economic confidence, especially with a 6.5 percent GDP growth outlook and easing inflation.

Why RBI Chose to Pause Again?

Rajeev Radhakrishnan, CIO – Fixed Income at SBI Mutual Fund, explained that RBI’s decision was expected. After earlier rate cuts this year, RBI seems to be waiting to see how the global economy and domestic demand shape up.

In 2025 so far, RBI has cut the repo rate by 100 bps between February and June, helping to bring down borrowing costs.

What This Means for You?

If you have a home loan, your monthly EMI will stay the same for now. If you're planning to take a new home loan, interest rates remain affordable.

With the RBI choosing to wait and watch, the focus remains on supporting growth, keeping inflation under control, and helping the housing sector stay strong.

(With IANS Inputs)