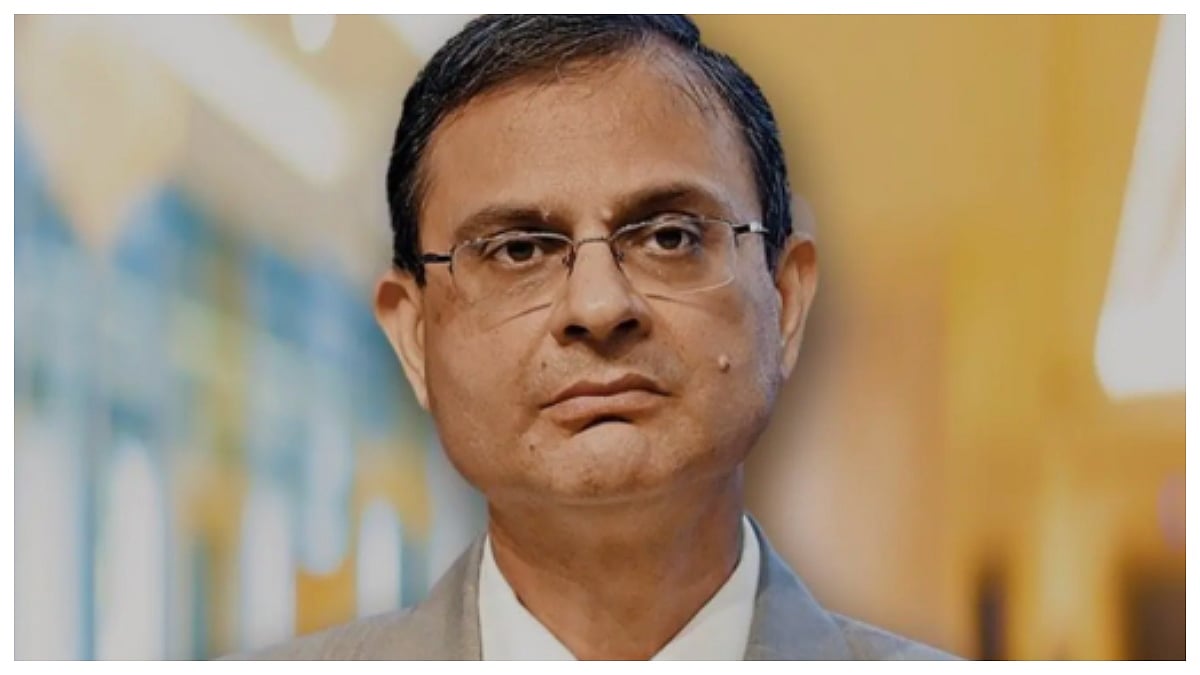

Mumbai: The Reserve Bank of India (RBI) is being very careful because of global tariff issues and tensions between countries. RBI Governor Sanjay Malhotra said that in such a situation, the central bank must move ahead cautiously.

Repo Rate Unchanged at 5.5 percent

In the Monetary Policy Committee (MPC) meeting held from August 4 to 6, all six members agreed to keep the repo rate at 5.5 percent. This means there is no change in interest rates for now.

Indian Economy is Strong and Stable

Governor Malhotra said that the Indian economy shows strength, stability, and opportunity. He added that India's solid economic position and forward-looking policies are helping the country stay on the right path.

Inflation Is Under Control, But Risks Remain

The governor mentioned that inflation is currently under control, mainly because of a drop in food prices. But he warned that inflation might rise slightly in the coming months due to global price changes and tariffs.

No Need to Change Interest Rates Now

Other MPC members also said that there is no need to cut rates at this time. Deputy Governor Poonam Gupta said the global and domestic economic situation does not support lowering rates further.

Economy Supported by Government Spending and Services

RBI Executive Director Rajeev Ranjan said India’s economy is being supported by government spending, rural demand, and a strong service sector. However, there are still some ups and downs in the industrial sector.

Caution Will Continue Unless Global Situation Improves

RBI has made it clear that it will continue to be careful due to inflation and global uncertainty. If global conditions become stable in the coming months, the RBI may then review its policy.