Mumbai: Public sector bank (PSU) stocks surprised the market by jumping up to 4 percent, on Wednesday, September 24, even as the overall market sentiment remained dull. The rally was led by reports that the government may allow more foreign investment in state-run banks.

Government May Raise FDI Limit in PSU Banks

According to The Economic Times, the government is working on a new policy that could allow foreign investors to own up to 49 percent of PSU banks, up from the current cap of 20 percent. However, the government will still keep a majority stake of over 51 percent in these banks.

If implemented, this move could bring in much-needed capital into the public banking sector, improving liquidity and boosting investor confidence.

Nifty PSU Bank Index Hits New High

The Nifty PSU Bank index was the top-performing sectoral index on Wednesday. It rose more than 1.5 percent to touch a fresh 52-week high of 7,567.50, beating its previous high of 7,473.00.

Big Gainers — SBI, Canara Bank, Indian Bank

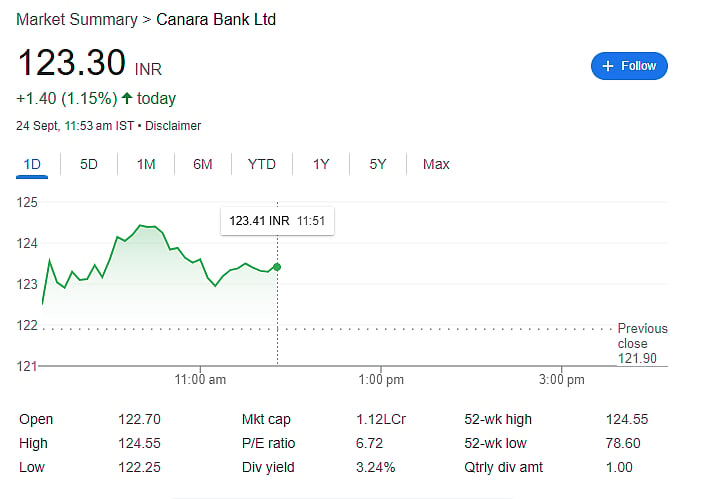

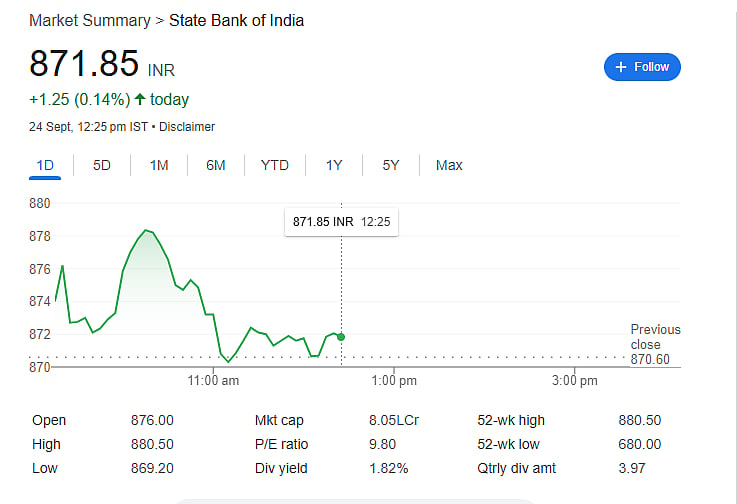

Several major PSU banks hit their one-year high levels:

- SBI (State Bank of India) rose by 1.13 percent to Rs 880.50 on the NSE.

- Canara Bank jumped over 2 percent to Rs 124.55.

- Indian Bank surged 3.8 percent to Rs 722.

Other notable gainers included Bank of Baroda, Indian Overseas Bank, Bank of India, and Punjab & Sind Bank.

Some Banks Missed the Party

While most PSU banks performed well, a few lagged behind. Maharashtra Bank, Union Bank of India, and Punjab National Bank (PNB) saw a dip from their highs and ended in the red.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a certified financial advisor before making any investment or trading decisions.