In what turned out to be a 'false start', the market has gone back to the red ways after starting on a positive note in the intraday trade on Monday. March 3.

Nifty Bank In Red

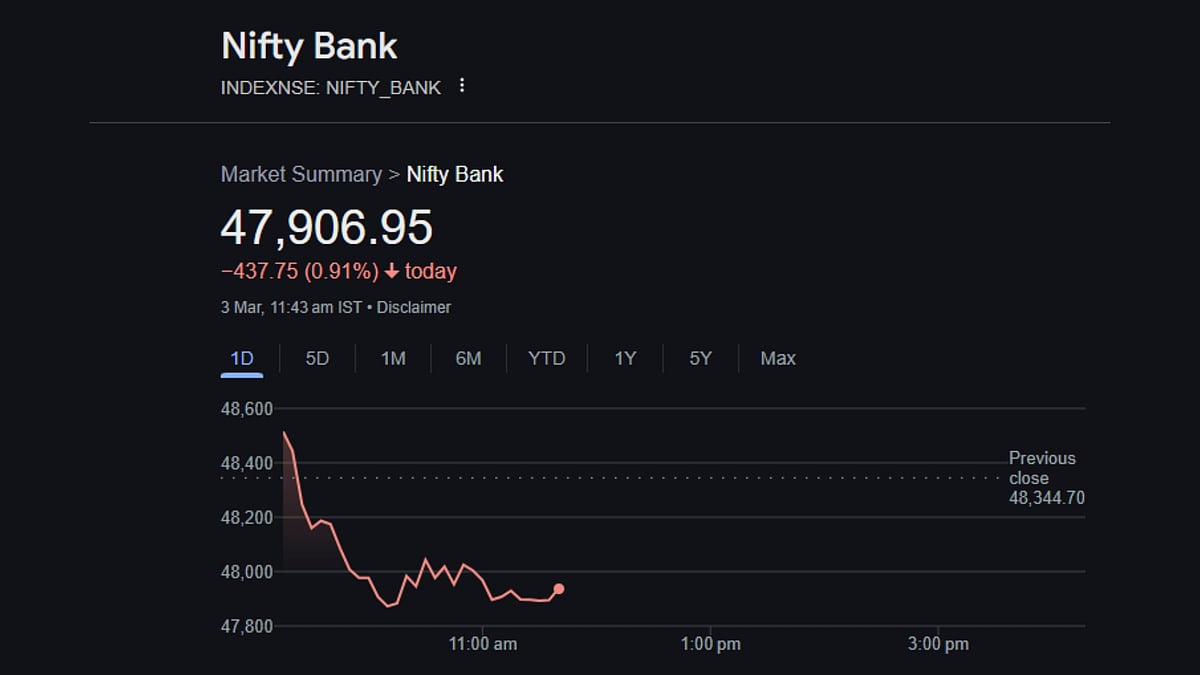

In this, while the marquee indices, the BSE Sensex and Nifty, were trading with cuts, the Nifty Bank index was trading with deeper cuts.

The banking index was one of the worst performing amongst all the major indices, with a cumulative loss of 0.91 per cent or 437.75 points, taking the overall value of the index to 47,906.95.

Indusind Bank Ltd

Here, amongst the contributors to this dramatic fall were the likes of IndusInd Bank, which, at the time of writing, was one of the worst performing among banking shares.

The stock suffered losses of 3.13 per cent or Rs 30.95, taking the overall value to Rs 959.15 per share.

HDFC Bank Ltd

HDFC Bank, another major bank from the private sector also dropped in value on Monday. The bank's shares dropped to Rs 1,704.00 per piece.

This took the overall difference to Rs 28.40 or 1.64 per cent.

Canara Bank Ltd

The publically-owned Canara Bank was also amongst the losers. The Bengaluru-based lender's shares dipped by 1.67 per cent or Rs 1.35.

This took the overall value of the index to Rs 79.55 per share.

Kotak Mahindra Bank Ltd

Kotak Bank was one of the few banking shares to trade in green with gains.

The shares of the bank founded by Uday Kotak reach the mark of Rs 1,911.00 per share. This came to pass after a rise of Rs 8.05 or 0.42 per cent.

RBI's Recent Actions

This comes at a time, when the RBI has swiftly moved to increase liquidity in the system.

After a rate cut in February, the RBI, last week, also lightened the Risk Weight on NBFC, making lending easier for these institutions.

In addition, last year, the RBI had also managed to to reduce the CRR or Cash Reserve Ratio. However, despite these steps, banks maybe reluctant to go back to speedy and rampant lending like before.