Mumbai: The Indian rupee slipped to a fresh historic low of 88.79 (provisional) against the US dollar on Tuesday, pressured by continued foreign capital outflows and growing concerns over global trade tensions.

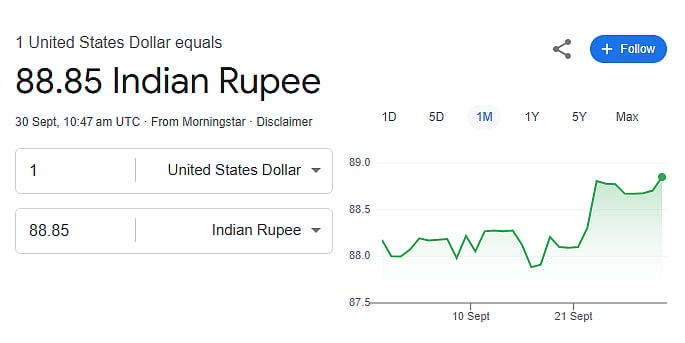

At the interbank foreign exchange market, the rupee opened at 88.73 and traded in a tight range between 88.69 and 88.80 before settling at 88.79. This marked a 4 paise drop from the previous closing rate. On Monday, the rupee had already ended lower by 3 paise at 88.75 per dollar.

According to forex traders, the fall was limited somewhat by a decline in global crude oil prices and a weaker US dollar. The Brent crude benchmark fell 1.03 percent to USD 67.27 per barrel in futures trading. Meanwhile, the dollar index, which tracks the greenback against six major currencies, was down 0.11 percent at 97.79.

Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP, noted that Foreign Portfolio Investors (FPIs) have continued selling Indian assets and buying dollars, creating downward pressure on the rupee. He added that the RBI seems to be intervening by supplying dollars to limit sharp volatility.

FPIs offloaded Rs 2,831.59 crore worth of Indian equities on Monday, adding to the currency market stress. On the equity front, the Sensex fell 97.32 points to close at 80,267.62, while the Nifty slipped 23.80 points to end at 24,611.10.

The currency’s slide comes just ahead of the Reserve Bank of India’s Monetary Policy Committee meeting scheduled for Wednesday. The market is watching closely to see whether the RBI will adjust interest rates or issue supportive policy guidance amid current market uncertainty.

The rupee has remained vulnerable since August, when US President Donald Trump imposed 50 percent tariffs on Indian exports. Adding further pressure, the US has now announced a 100 percent tariff on patented or branded Indian drugs starting October 1, unless firms build production plants in the US.

With pressure building, traders expect the rupee to move between 88.50 and 89.00 in the near term.