Indian Overseas Bank (IOB), a state-run bank, reported a 26.5 per cent year-over-year increase in net profit in the first quarter of the 2024–25 financial year, to Rs 632.8 crore, from Rs 500.35 crore in the same period the previous year. This increase was primarily due to strong sequential business momentum.

NII (Net Interest income)

The net interest income (NII) of the lender increased by 5.1 per cent to Rs 2,441 crore during the same period last year, from Rs 2,322.8 crore. Deposits at the Chennai-based bank increased 4.5 per cent quarterly and 13 per cent annually to Rs 2.98 lakh crore in the April–June period.

The bank's advances increased to Rs 2.24 lakh crore during the review period, up 24.7 per cent year over year and 5.3 per cent sequentially.

Net and gross NPA (non-performing assets)

The bank's gross non-performing assets (GNPA) at the end of the June 2024 quarter were Rs 6,648.7 crore, a 2 per cent decrease from Rs 6,794.4 crore at the end of the previous fiscal quarter. As of Q4 FY25, the bank's net non-performing asset (NPA) was Rs 1,153.5 crore, down 5.2 per cent QoQ from Rs 1,216.9 crore.

Additionally, as of the June quarter, the provision coverage ratio increased to 96.96 per cent from 96.85 per cent in the corresponding quarter of the previous fiscal year.

Share Performance

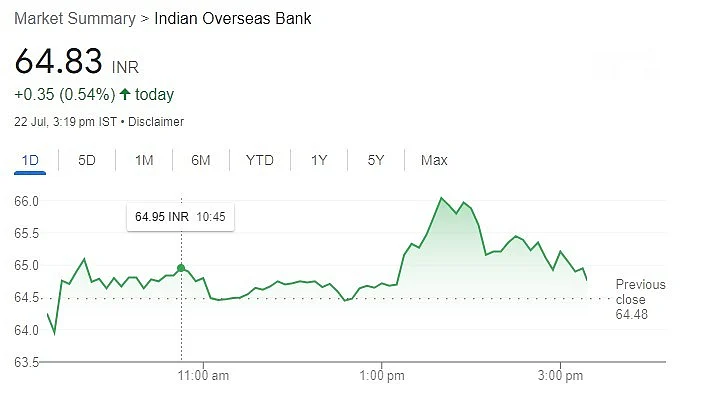

The Indian Overseas Bank share was trading around Rs 64.88 per share on indian bourses at closing time. The stock touched a 52-week high of Rs 83.75 per share on February 8, 2024.