Mumbai: On Wednesday, expectations of a possible trade agreement between India and the United States led to a sharp jump in textile company stocks.

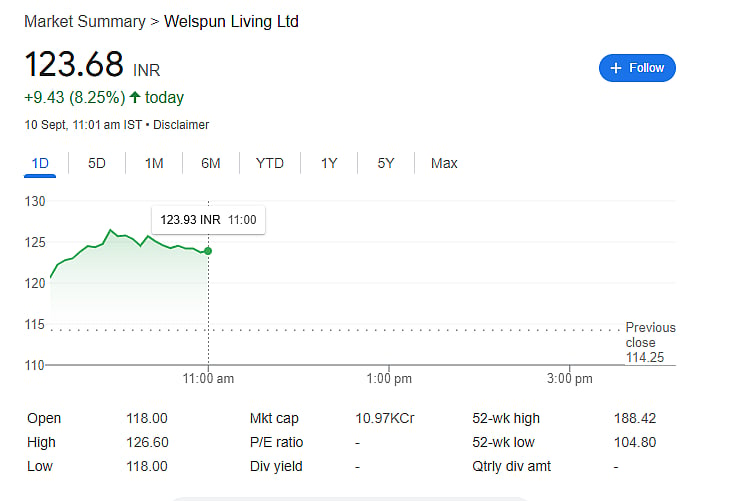

Welspun Living shares surged over 9 percent to trade at Rs 124.55. Gokaldas Exports gained more than 7 percent, while stocks of companies like Trident, Pearl Global, and Vardhman Textiles also rose between 4 percent and 6 percent.

This stock market rally came after US President Donald Trump posted on Truth Social that trade talks with India are ongoing and he looks forward to speaking with Prime Minister Narendra Modi.

In response, PM Modi called the US a "close and natural friend" on social media and also shared his hope about the upcoming talks with President Trump.

Why Were Tariffs Imposed Earlier?

The Trump administration had imposed an extra 25 percent tariff on Indian exports, mainly due to India's oil trade with Russia.

This move impacted over 66 percent of Indian exports in key sectors like textiles, seafood, and gems & jewellery.

To stay competitive, Indian exporters had to offer 15 percent to 20 percent discounts to US buyers, which hit their earnings and job creation badly.

Pearl Global warned that if these high tariffs continued, around $6 billion in exports might shift to other countries, putting millions of jobs at risk.

Fresh Optimism Among Investors

In the past month, textile stocks had fallen 15 percent to 20 percent due to trade tensions. But the recent signs of a possible deal have lifted market sentiment.

Investors are now hopeful that stronger India-US trade ties will benefit not just the textile sector, but also many other industries in the future.