Mumbai: The rupee soared to a near six-week high against the dollar today because of persistent dollar sales by banks likely for foreign portfolio investor inflows into Indian equity markets and ongoing initial public offerings, dealers said.

The Indian unit settled 0.6% higher at 81.4350 dollar today, the highest closing level since Sep 30.

The Indian unit opened 53 paise stronger at 81.3900 a dollar today because the dollar slipped globally as the euro strengthened, tracking a rise in eurozone bond yields.

A steady climb in German bond yields weakened the dollar due to expectations of further tightening by the European Central Bank.

Investors also exercised caution ahead of the US consumer price data on Thursday. The US inflation is widely expected to come down to 7.9% in October from 8.2% last month, according to a Bloomberg survey.

Rupee rallied tracking weakness in dollar globally as well as steady FII flows into domestic markets said a dealer with private bank.

Expectation of the Republicans taking back the House of Representatives and the Senate, which could create a gridlock in the Congress and curtail President Joe Biden's ability to pursue expansive fiscal policy plans, also dented appeal for the safe-haven US dollar.

Dollar fall is due to risk on sentiment, globally traders are reacting as if Republicans will change the picture said a dealer with private bank. "For rupee, 81.00 (a dollar level) should act as very crucial support.

At 15:53 IST, the dollar index, which measures the strength of the greenback against a basket of six major currencies, was at 109.73 compared with 109.64 on Tuesday. It was at 110.12 on Monday.

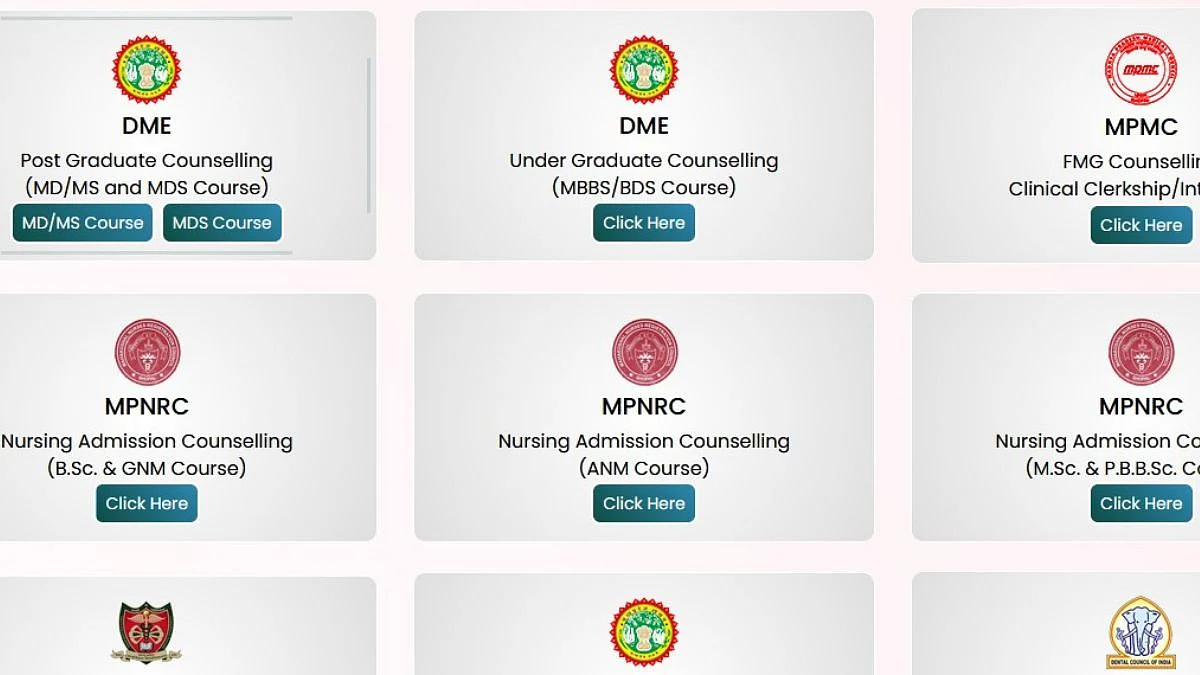

Besides the weak dollar, likely foreign portfolio inflows into Indian equity market ahead of semi-annual index rebalancing of the MSCI India index, and for ongoing IPOs also aided the Indian currency, dealers said.

After net seller in the tune of $20 bln in 2022, FPIs have invested around $2 bln rupees in the Indian equities in November so far.

Market participants expect around $1 bln inflows this week on account of rebalancing of MSCI index, which is scheduled to take place on Friday and the changes will come into effect after the close of trade on Nov 30.

However, the demand for dollar remains firm as banks persistently purchased dollars on behalf of importers to take advantage of the relatively lower dollar/rupee levels.

"The high in rupee should be a good level for importers to buy, while 82-82.20 should come up in a few days", said a dealer with a brokerage firm.

Due to the dollar demand from oil marketing companies and other importers, the rupees erased some gains after touching the day's high of 81.2250 a dollar.

The dollar index fell around 3% in the last four trading sessions, while the rupee gained only 1.7% during the same period as dollar demand from importers weighs on the rupee.

With inputs from agancies