In India’s dynamic property market, the phrase “distress sale” immediately catches attention. For buyers, it can signal the chance to acquire a property at a price well below market value. For sellers, it usually reflects an urgent need for liquidity — often due to financial strain, relocation, or legal issues. While these deals can offer attractive opportunities, they also carry unique risks that must be carefully managed.

Great Opportunities

Significant Price Advantage: Distressed resale properties are often 10–40% cheaper than similar homes in the same locality, providing an entry point into otherwise unaffordable neighbourhoods.

Faster Transaction Closure: Motivated sellers tend to expedite negotiations, enabling quicker possession and deal finalisation.

Investment Upside: A well-located distressed property with a clear title, once regularised or renovated, can yield strong capital appreciation or rental returns.

Access to Prime Locations: Distress sales sometimes involve homes in sought-after areas where inventory is otherwise scarce.

Multiple Risks

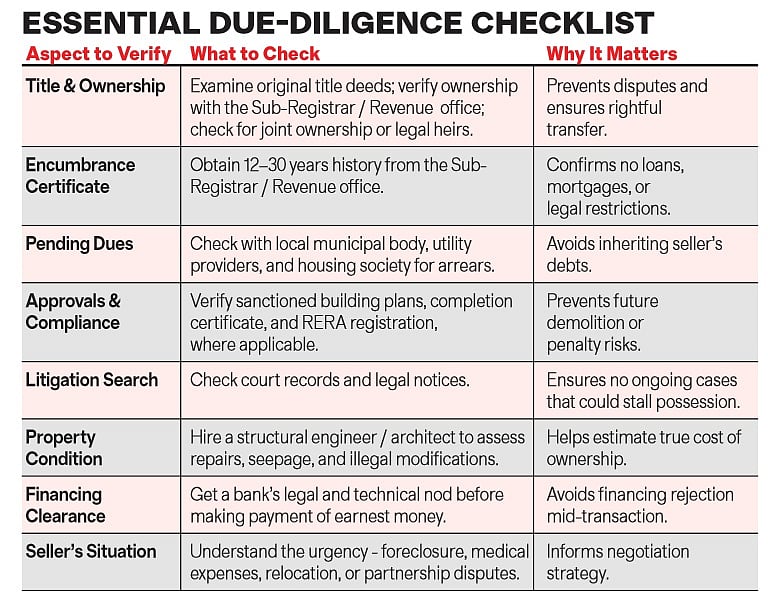

Title and Ownership Disputes: Some distressed properties may have unclear ownership histories, unregistered transactions, or competing claims.

Encumbrances and Dues: Outstanding home loans, property tax arrears, or society maintenance and electricity charges may become the buyer’s liability if not identified.

Regulatory Non-Compliance: Unapproved constructions or missing occupancy/completion certificates can invite penalties or even demolition orders.

Litigation Risks: Ongoing court cases involving inheritance disputes, builder-buyer conflicts, or bank recovery proceedings can stall possession indefinitely.

Loan Hurdles: Banks may be cautious in funding distress properties until all legal and technical issues are cleared.

Hidden Repair Costs: Years of neglect can result in significant structural or maintenance expenses post-purchase.

Case Study

A striking example of a distress sale in India was the auction of a very famous villa in Goa. Once a lavish party hub owned by a flamboyant businessman, it was seized by lenders after loan defaults by the said gentleman. The property, valued at over Rs. 100 crore, was put up for multiple auctions at steeply reduced prices before finally selling for around Rs. 73 crore in 2017.

Key Lessons

Patience Pays: Early auctions often fail due to high reserve prices; waiting can lead to deeper discounts.

Legal Clarity is Critical: Bank auctions may still require thorough title verification to ensure no pending litigation or hidden liabilities or vacant possession.

Market Perception Matters: Even a luxury property in a prime location can struggle to sell if linked with legal controversies or a tarnished brand.

Closing Thoughts

Distress-sale resale properties in India can be goldmines for both investors and end-users - but only when approached with discipline. The promise of a low price should never override the need for thorough legal, technical, and financial checks. A patient, well-researched approach, supported by experienced real estate and legal professionals, can transform a distressed listing into a rewarding investment rather than an expensive lesson.

The writer is Vice Chairman & Chair-Global, NAR India