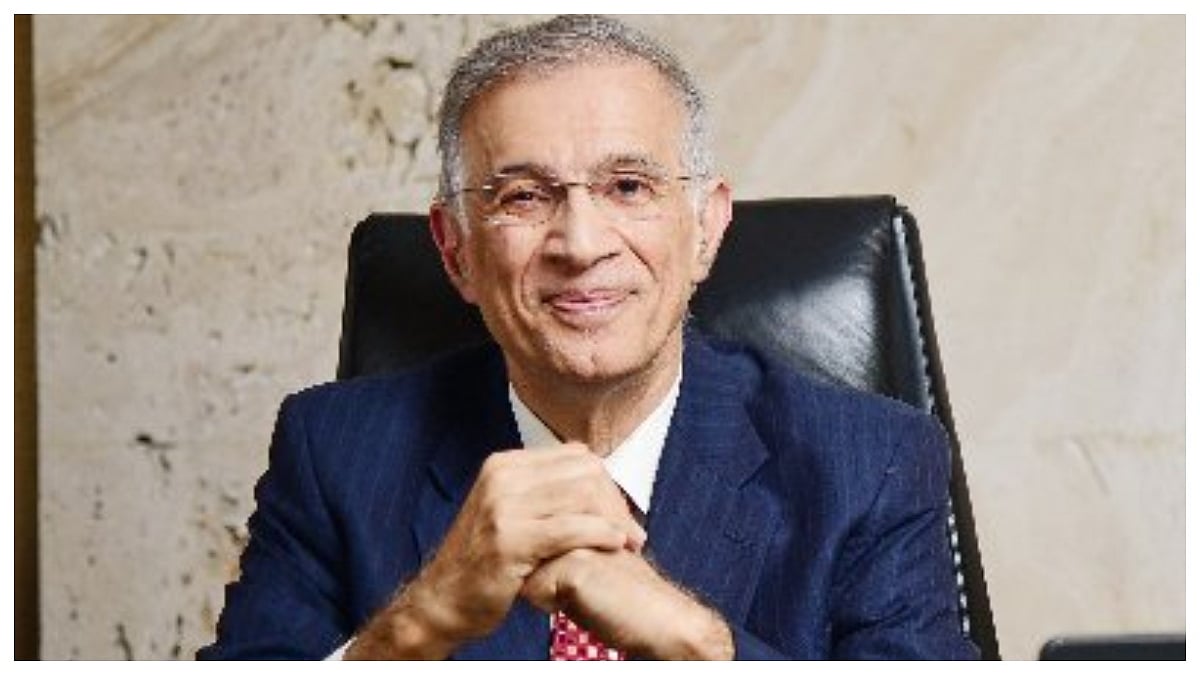

In the latest episode of the Simple Hai! podcast, veteran finance journalist Vivek Law, along with Vikas Satija, Managing Director and CEO of Shriram Wealth, discussed the evolving wealth management industry. Satija, a seasoned professional who has been part of the mutual fund sector since its early days in India, shared sharp insights on investor behavior, the role of technology, and Shriram Wealth’s ambitious roadmap.

Rethinking Wealth Management in Modern India

Reflecting on the early years of his career in 1998-99, Satija recalled how discussions about money were often considered inappropriate. Parents even discouraged their children from being part of financial conversations in banks. Wealth management was seen as a privilege of the elite, with little relevance to the middle class.

That perception transformed dramatically. Today, India counts nearly 30 lakh households with a financial surplus of ₹2 crore or more, excluding gold and real estate. Central to this shift has been the rise of Systematic Investment Plans (SIPs). Initially met with scepticism, SIPs have fueled unprecedented growth in the mutual fund industry from ₹8,000 crore to ₹27,000 crore over the last five years alone.

The true marker of maturity, Satija noted, was evident during the Covid-19 crisis. Unlike the 2008–09 crash, when panicked investors exited en masse, Indian investors continued investing through SIPs during the pandemic. This resilience demonstrated an evolved understanding: wealth creation is a long-term process, not a short-term gamble.

Artificial Intelligence: Empowering, Not Replacing

Satija addressed the growing apprehension surrounding Artificial Intelligence (AI) in finance, explaining that AI’s true purpose is not to replace human advisors but to empower them. Noting the scarcity of experienced talent in the industry, he illustrated how AI-driven analysis can instantly model the impact of events such as tariffs on investment portfolios, a task humans cannot accomplish in real-time. “AI makes advisors more effective, allowing them to guide clients better,” Satija told Law, firmly positioning technology as a catalyst rather than a competitor.

A Historic Shift in Attitude

Historically, wealth management in India was seen as the preserve of the wealthy, with money matters often shrouded in secrecy. Satija recounted his early days in asset management, where discussing investments could feel almost taboo, and families routinely excluded children from financial conversations. Financial literacy and middle-class participation in wealth creation has shifted the balance. Satija highlighted how retail investors now play a critical role in market stability, reducing volatility caused by foreign institutional inflows and outflows.

From Product Push to Solutions-Driven Advice

A recurring critique of the wealth management sector has been its product-driven approach. Relationship managers often push specific instruments without regard for the client’s broader goals, sometimes disappearing altogether if a sale is not made.

Satija was candid in admitting this and underscored Shriram Wealth’s mission. “We focus on solutions, not products,” he emphasised. The company’s approach begins with assessing the client’s risk profile, then devising a comprehensive financial strategy. Only after this groundwork is done are products chosen, whether in mutual funds, lending, insurance, or global opportunities.

“Our architecture is completely open,” Satija explained. “We are not tied to any single product, ensuring that the client gets the best possible solution.”

The “Phygital” Model: Blending Tech with Human Touch

Shriram Wealth’s unique positioning lies in its ‘phygital’ strategy. “Technology adds convenience, but cannot replace human insight and relationships,” he emphasised. The company’s “phygital” model ensures a blend of digital tools and physical presence, recognising that critical moments in wealth management require the assurance and understanding only a dedicated advisor can provide.

Making Wealth Management Truly Accessible

Satija insisted that Shriram Wealth is committed to democratising financial advice. Originally focused on clients with portfolios above ₹2 crore, the company is now lowering entry thresholds to ₹10 lakh, aiming to serve a broader spectrum of Indian households within the next six to nine months. This creates three clear client segments: Emerging Affluent (₹10 lakh - ₹2 crore), HNIs (₹2 crore - ₹25 crore), and Ultra HNIs (₹25 crore and above), tailored to differing needs and aspirations.

Defining Traits of Successful Wealth Creators

Reflecting on the habits of people who have built lasting wealth, Satija named three defining traits:

- Patience: Staying invested and monitoring portfolios for the long term.

- Recognition: Actively investing long term along with one’s core business

- Portfolio Engagement: Consistently dedicating time to rebalance portfolios, ensuring broad-based growth.

“Those who don’t spend time on diversification, realise that they have invested all their money in one asset class, when they might have wanted to diversify their portfolio in reality,” he told Law.

As India’s financial sector matures, Satija believes, the balance between technology and trusted advice, the shift from product to solutions, and the democratization of expertise will be central themes shaping its future.