New Delhi: A major change in GST rates is on the way. In a key meeting, the Group of Ministers (GoM) on GST has approved the Centre’s proposal to simplify the tax structure.

Only Two Main Tax Slabs Proposed

The current GST system has four tax slabs — 5 percent, 12 percent, 18 percent, and 28 percent. The new proposal suggests keeping only two main slabs:

- 5 percent for essential goods

- 18 percent for standard goods

- 40 percent Tax on Harmful Products

Goods like tobacco and pan masala, which are harmful to health, may be taxed at a special rate of 40 percent under the new system.

Why the Change?

The government wants to:

- Make the tax system easier

- Give relief to the common people, farmers, middle class, and MSMEs

- Ensure transparency and simplicity

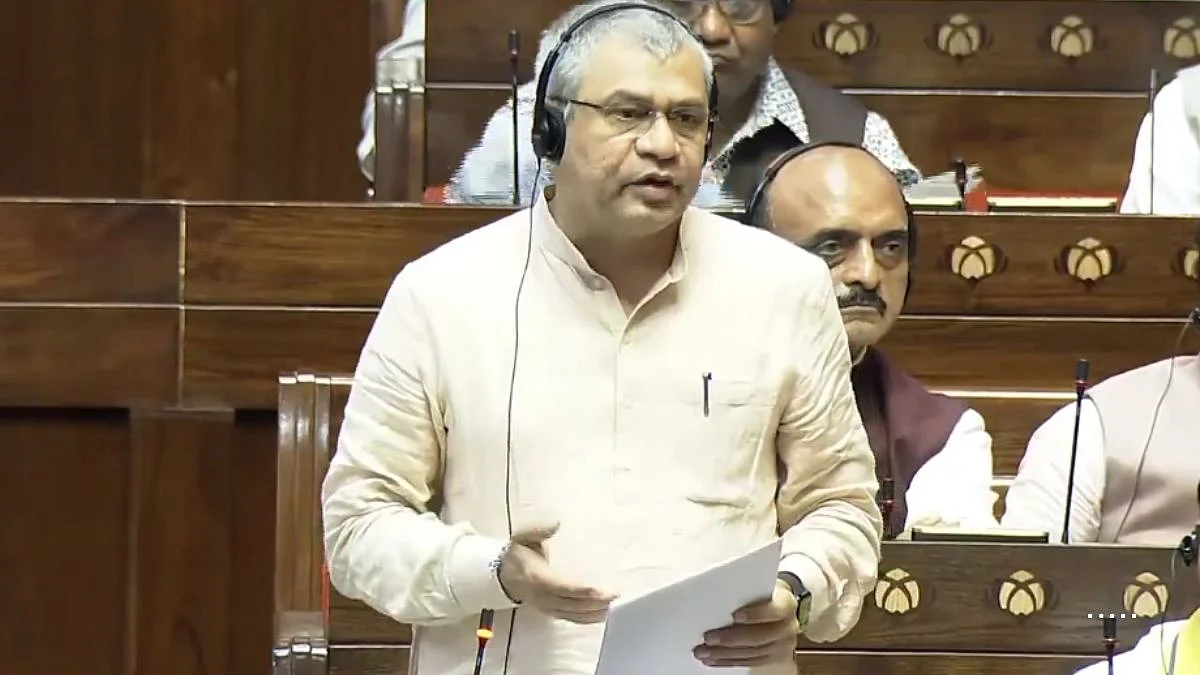

Approval by GoM Led by Bihar Deputy CM

The six-member GoM, led by Bihar Deputy Chief Minister Samrat Choudhary, has agreed to replace the current four-tier GST system with the proposed two-tier system.

Finance Minister’s Statement

Finance Minister Nirmala Sitharaman said that this change will help people and small businesses, and will make the GST system more user-friendly and clear.

Current GST Slabs at a Glance

- 0 percent or 5 percent: Food and essential items

- 12 percent & 18 percent: Most services and goods

- 28 percent + cess: Luxury and harmful products

Bihar Deputy Chief Minister Samrat Choudhary, who leads the Group of Ministers (GoM) for GST rate changes, said that the panel has agreed to a major reform in GST rates.

12 percent and 28 percent Slabs to Be Removed

The GoM has accepted the Centre's proposal to remove the 12 percent and 28 percent GST slabs. Now, only two main tax rates — 5 percent and 18 percent — are being considered.

Extra Tax on Luxury and Harmful Goods

Uttar Pradesh Finance Minister Suresh Kumar Khanna said that the proposal also includes a 40 percent GST on ultra-luxury and sin goods (like expensive cars, tobacco, pan masala, etc.).

West Bengal Wants to Keep Total Tax Same

West Bengal Finance Minister Chandrima Bhattacharya said her state wants an additional levy on top of the 40 percent GST to make sure that the overall tax amount stays the same as it is now for luxury items.

Concern Over Revenue Loss

Bhattacharya also raised a concern that the Centre’s proposal did not mention how much revenue the Centre and states might lose if these changes are made.