Mumbai: Bajaj Electricals saw a strong rise in its share price after announcing its earnings for the fourth quarter of financial year 2024-25. On Monday, May 12, the company reported that its net profit for the January to March period jumped 103 per cent to Rs 59.05 crore. This is more than double the Rs 29 crore profit it reported in the same quarter last year.

The company also reported growth in its revenue. Bajaj Electricals posted a 6 per cent increase in its topline to Rs 1,265 crore. This is up from Rs 1,188 crore reported in the March quarter of the previous year.

Along with the earnings, the company’s board also announced a dividend. It has recommended a dividend of Rs 3 per share. This is 150 per cent of the face value of Rs 2 per share. The dividend is for the financial year ending March 31, 2025.

The record date for this dividend is July 18, 2025. This means shareholders who hold the stock by that date will be eligible to receive the dividend. However, the dividend still needs to be approved by shareholders at the upcoming annual general meeting. If approved, the dividend will be credited to shareholders by August 11, 2025.

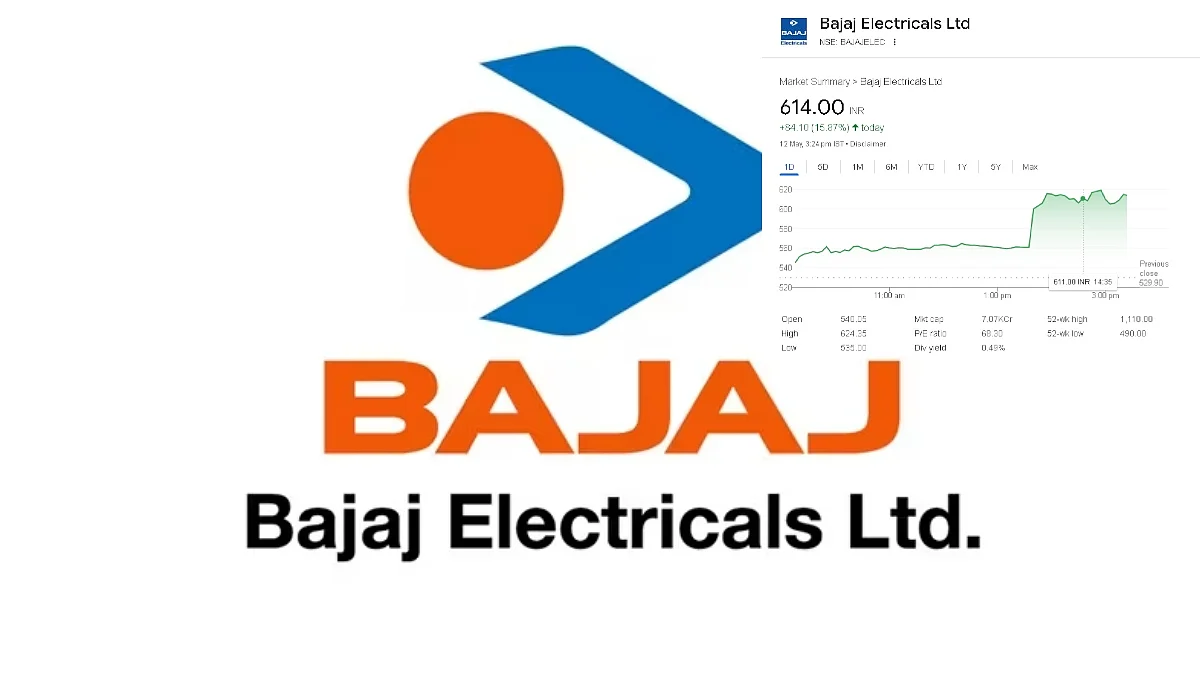

Investors reacted positively to the news. Following the results and dividend announcement, Bajaj Electricals shares rose by nearly 15 per cent in trading on May 12. The stock is currently priced at Rs 609.

This strong one-day performance comes despite the stock being down over 20 per cent so far in 2025. The sharp rise in quarterly profit and the promise of a dividend appear to have brought back some investor confidence.

Overall, the company has shown good profit growth and has rewarded shareholders with a dividend. Investors will now be watching to see if the company can keep this growth going in the coming quarters.