The Reserve Bank of India (RBI) has approved a Rs 2 hike on ATM interchange fees. The RBI increased the interchange fees on financial transactions. In addition, the central bank also approved a Re 1 hike on non-financial transactions.

This change in transaction fee will come into effect in the new fiscal year, FY26, on May 1.

Previously, such a revision in fees was carried out in June 2021.

What Are Interchange Fees?

Here, interchange fees are transaction fees charged between banks. Here the fee is charged between the acquiring bank and the issuing bank.

Such fees are charged for transactions involving processing credit and debit card payments, helping cover the issuing bank's costs.

This also allows for better card acceptance.

This comes to pass after the National Payments Corporation of India (NPCI) reportedly recommended these changes in February. |

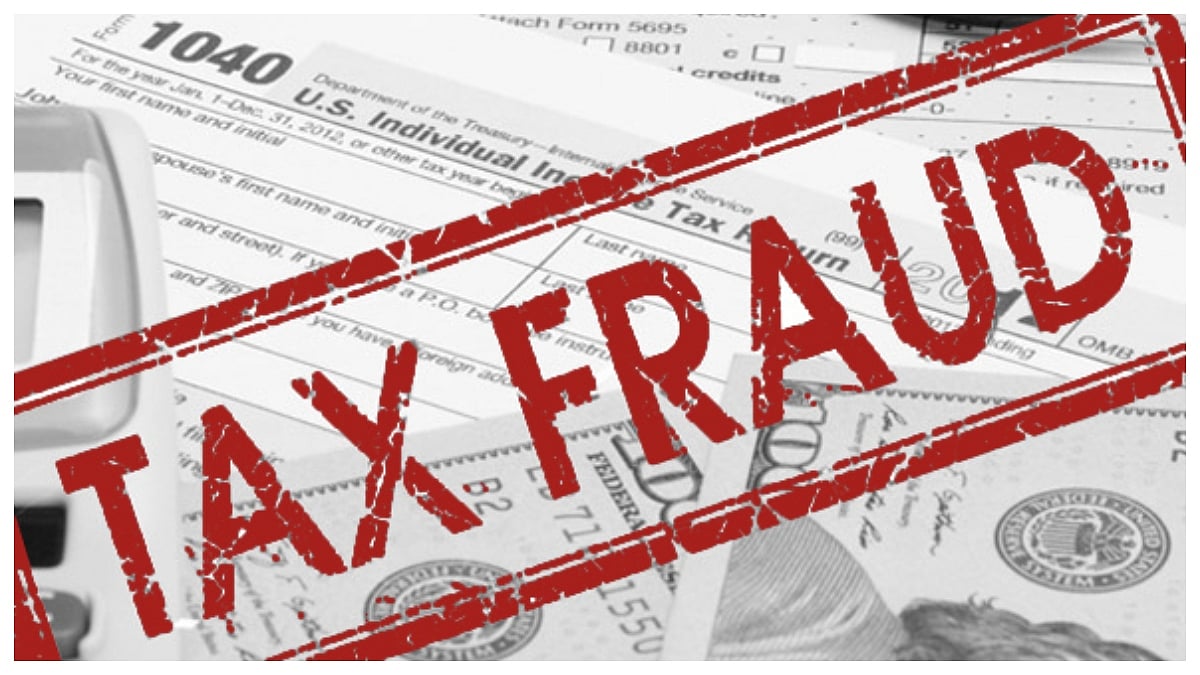

What Do These Changes Mean?

As per reports, this is expected to affect smaller banks, with limited ATM networks adversely.

As a result of this hike, the interchange fee for crucial activities like cash withdrawals, has been increased from Rs 17 to Rs 19.

When it comes to non-financial transactions, which may include balance enquiries, the fee has been increased from Rs 6 to Rs 7.

When it comes to non-financial transactions, which may include balance enquiries, the fee has been increased from Rs 6 to Rs 7. | Representative Image

NPCI Recommendations

This comes to pass after the National Payments Corporation of India (NPCI) reportedly recommended these changes in February.

Previously, the NPCI had also recommended increasing the maximum cash transaction fees.

This would mean that the transaction fee would rise to Rs 22 from its current level of Rs 21 per transaction.