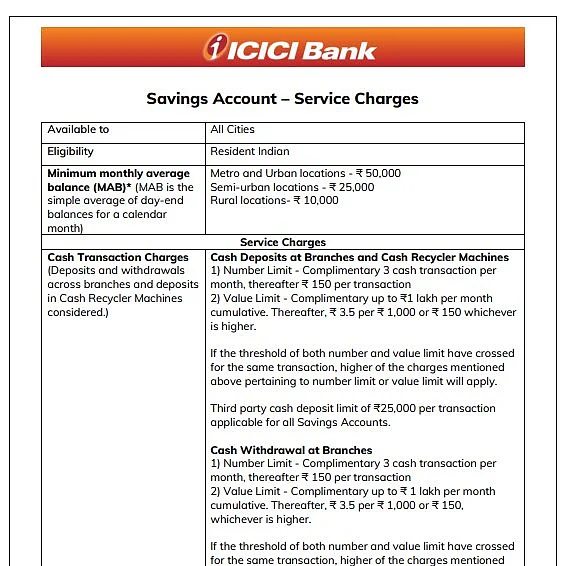

Mumbai: ICICI Bank announced a steep hike in the minimum average monthly balance (MAMB) requirement for new savings accounts to be opened on or after August 1, 2025.

In metro and urban branches, the MAMB will increase to Rs 50,000 from the current Rs 10,000. For semi-urban branches, the requirement will be Rs 25,000, up from Rs 5,000, while rural branches will see the balance requirement double to Rs 10,000 from Rs 5,000. These changes will apply only to newly opened savings accounts from the effective date, as per the bank’s updated terms and conditions.

Details on revised charges |

Revised Charges For Cash Transaction

The bank has also revised its cash transaction charges. Customers will be entitled to three complimentary cash deposit transactions per month at branches and cash recycler machines. Beyond this, each additional transaction will incur a fee of Rs 150. A cumulative monthly deposit limit of Rs 1 lakh will remain free of charge, after which a fee of Rs 3.5 per Rs 1,000 or Rs 150, whichever is higher, will be levied. Third-party cash deposits will be limited to Rs 25,000 per transaction.

Cash withdrawals at branches will follow a similar structure: three free transactions per month, Rs 150 for each subsequent transaction, and a free cumulative monthly withdrawal limit of Rs 1 lakh. Transactions exceeding this limit will attract the same Rs 3.5 per Rs 1,000 or Rs 150 charge. Third-party withdrawals will also be capped at Rs 25,000 per transaction.

Deposits made through cash acceptor or recycler machines during non-working hours (4:30 p.m. to 9:00 a.m.) and on holidays will be charged Rs 50 per transaction if the total deposits exceed Rs 10,000 in a month, whether made in a single or multiple transactions. This fee will be in addition to standard cash transaction charges.

For ATM usage at non-ICICI Bank ATMs in six metro cities, Mumbai, New Delhi, Chennai, Kolkata, Bengaluru, and Hyderabad, the bank will levy Rs 23 per financial transaction and Rs 8.5 per non-financial transaction after the first three combined transactions (financial and non-financial) in a month.