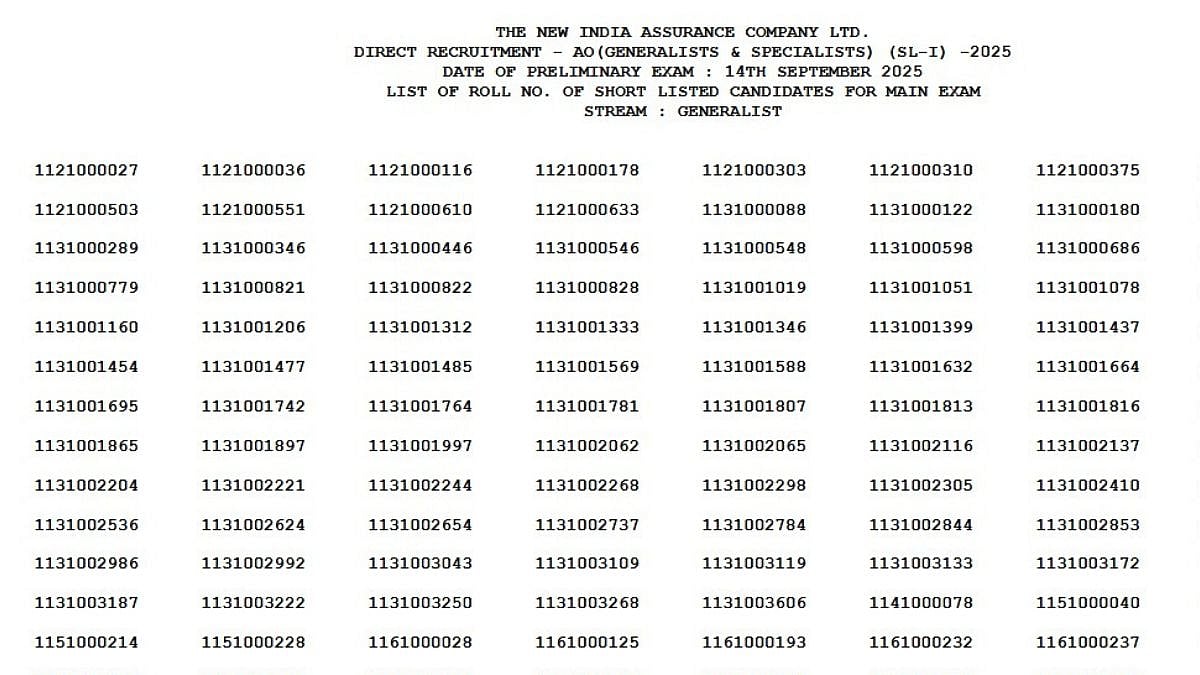

Mumbai: After gold created history by crossing the USD 4,000 mark on October 1, all eyes are now on silver, which is inching closer to breaking a major milestone of its own — USD 50 per ounce. As of October 9, silver is trading at USD 49.02, just short of its historical high of USD 49.95, set in January 1980.

Past Highs — Some Controversial

Silver’s first major price peak in 1980 was linked to a controversial attempt to corner the market, which eventually led to a price crash. The second peak came in 2011, when silver touched USD 48.70, this time driven by real demand. On October 8, 2025, silver touched USD 48.74, very close to that mark, and is now set to break above both previous records.

Silver Outperforming Gold in 2025

While gold has stolen the spotlight by hitting USD 4,000, silver has actually delivered better returns in 2025. Over the past month, silver rose nearly 20 percent, while gold gained 11 percent. Year-to-date (YTD), silver has gained an impressive 70 percent, compared to gold’s 53 percent. In the last 12 months, silver has jumped over 60 percent, while gold rose 54 percent.

Long-Term Trends Show Silver Wins in Big Rallies

Historical data shows that silver tends to outperform gold during major price rallies. In previous bull runs — like 2003 to 2008, 2008 to 2011, and 2018 to 2021 — silver delivered stronger gains. One standout period was from December 2008 to April 2011, when silver soared 353 percent, while gold gained only 78 percent.

Gold-to-Silver Ratio Signals More Room for Silver

As silver prices rise faster than gold, the gold-to-silver ratio has fallen from a peak of 100 to 82, though it’s still above the long-term average of 70. With gold around USD 4,040 and silver nearing USD 49, there may still be room for silver to climb, especially if gold holds steady or cools slightly.