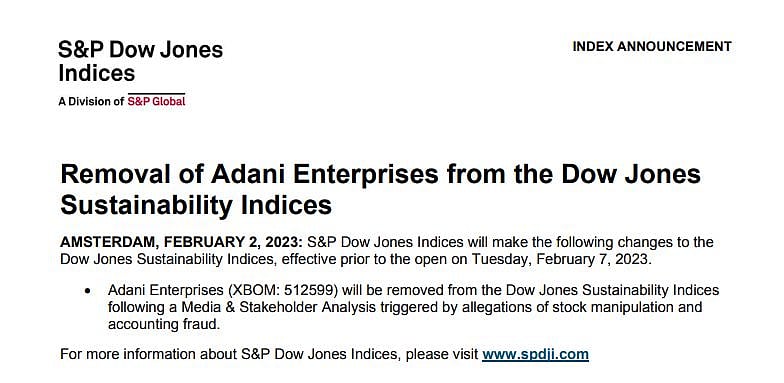

Trouble seems to be mounting for Adani Group since the Hindenburg report's release. In latest, Adani Enterprises will be removed from S&P Dow Jones Sustainability Indices before their opening on February 7, according to a report by Mint.

In a statement, they said that Adani Enterprises will be removed from the indices following a media and stakeholder analysis triggered by allegations of stock manipulation and accounting fraud.

Read the statement below:

PM

Adani Enterprises' removal from the Dow Jones comes a day after National Stock Exchange put three stocks of the Adani Group-- Adani Enterprises, Adani Ports and Ambuja Cements--under the additional surveillance measure from today, February 3.

What are Dow Jones Sustainability Indices?

The Dow Jones Sustainability Indices rank companies in 61 industries and then score them based on their responses to the S&P Global Corporate Sustainability Assessment. These scores of indices are like benchmarks for investors that consider sustainability as one of their parameters when adding stocks to their portfolios. This also encourages the companies to improve their corporate sustainability practises.

How does it affect the Adani Group?

This will not directly impact the shares of Adani Group, but there is a chance that it will discourage investors from buying the shares of Adani Enterprises.

Credi Sussie and CitiGroup gives nullified lending value to Adani stocks

This is not all; the group has also lost support from Credit Suisse and CitiGroup. With Credit Suisse giving a zero-lending value to Adani Ports, Adani Green, and Adani Electricity, this directly impacted the market as investors have been hesitant to purchase the stocks of Adani enterprise, which is why Adani shares have seen a drop of over 26 per cent.

Even CitiGroup has reportedly nullified the lending value of Adani group and has stopped giving margin loans on Adani Securities.

Adani vs Hindenburg Research

Adani Group has been in focus since a report from Hindenburg Research which alleged that the group was involved in improper use of offshore tax havens.

Adani calls off their FPO

The group also called off their FPO valued at Rs 20,000 crore despite achieving full subscription. Gautam Adani said going ahead with it would not have been "morally correct" after their stock prices dipped.