Loading-Loop, Access Denied, Network Issue, Blank Screen... ITR Faces Glitch; Netizens Share Frustration

With deadline for filing Income Tax Returns nearing, netizens share their experiences. Here is a probable reason for the several glitches and system downtimes.

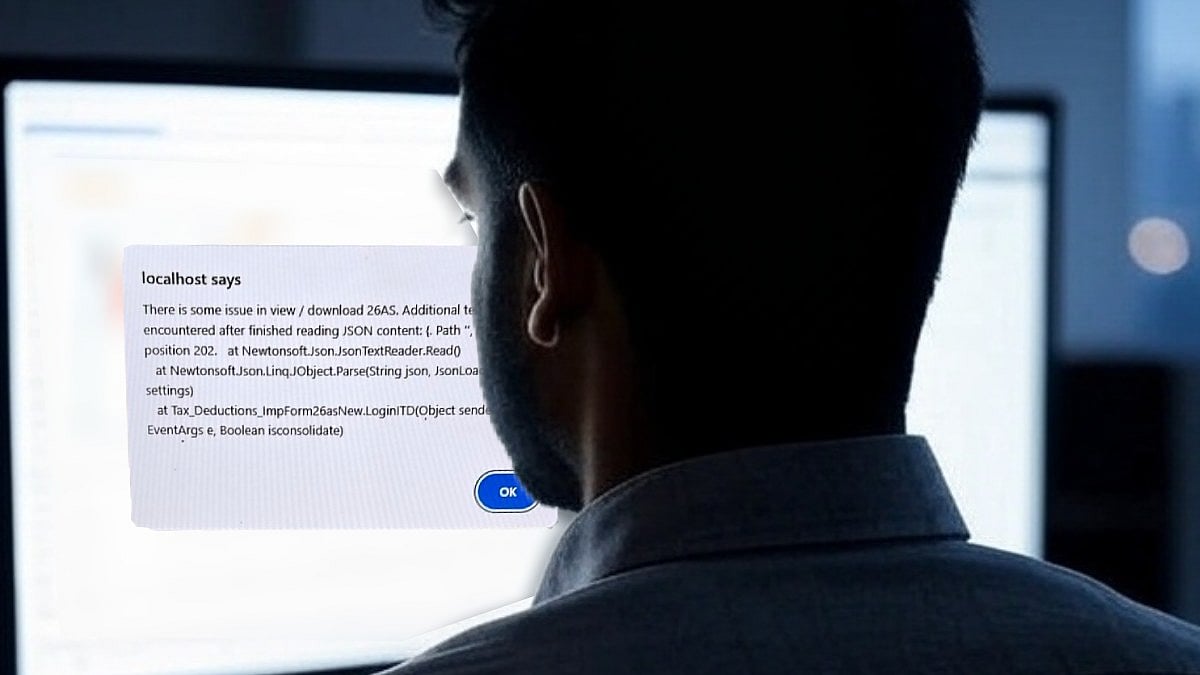

Errors while filing ITR forms | Edited image generated from Social Media and AI tools.

Extension of dates for filing Income Tax Return (ITR) has gathered steam on social media channels such as X. Professionals such as CAs and Advocates too joined the call to seek an extension in dates for filing of ITRs.

Users reported loading-loop, network related issues, and even blank screens during filing of ITRs as well as to comply with AIS guidelines. Users also appeared confused whether to upload from JSON templates or to use the ready-made templates. Users with more than one source of revenue appeared to complain.

Clash of advance tax deadline along with ITR is a probable theory causing friction for several users. Many users including professionals complain of the downtimes on the Indian tax agency's website. Netizens are now demanding extension of dates for filing income tax returns.

An X user, apparently an Advocate, shared his experience:

Some netizens and Chartered Accountants seemed confused over the dates for Filing of Income Tax for AY 2024-25 with Advance Tax for 2025-26. Since the dates for both is set at September 15th, it is likely that users are confused over which tax file to opt for.

Besides AIS forms, there were also reports of users unable to file Form 26AS as the form did not load on the webpage. From Loading Loop to Access denied, users reported of a wide variety of errors. In some cases the website also displayed a Network Issue while some had to stare at a blank screen after clicking on the submit button.

ALSO READ

Advance tax has confused a number of users, especially for users with capital gains tax liability. That since advanced tax computations are as per two due dates - the first installment of June and the second one as on September. Users who were unable to pay the first instalment will have to pay the penalty, however failure on the second instalment is likely to cause a significant outgo causing unrest among users.

While calls for extension has been a common occurrence on social media, especially around due dates, some users also shared their positive experience. A Chartered Accountant reported that the tax agency delivered refund as fast as "Swiggy delivers food".

RECENT STORIES

-

-

-

-

-