Why Did Sensex & Nifty Fall Today? US Tariff Threat Triggers Market Drop | Explained

Indian stock markets fell sharply today after the US announced a draft plan to impose 25 percent extra tariffs on Indian goods from August 27, creating panic among investors.

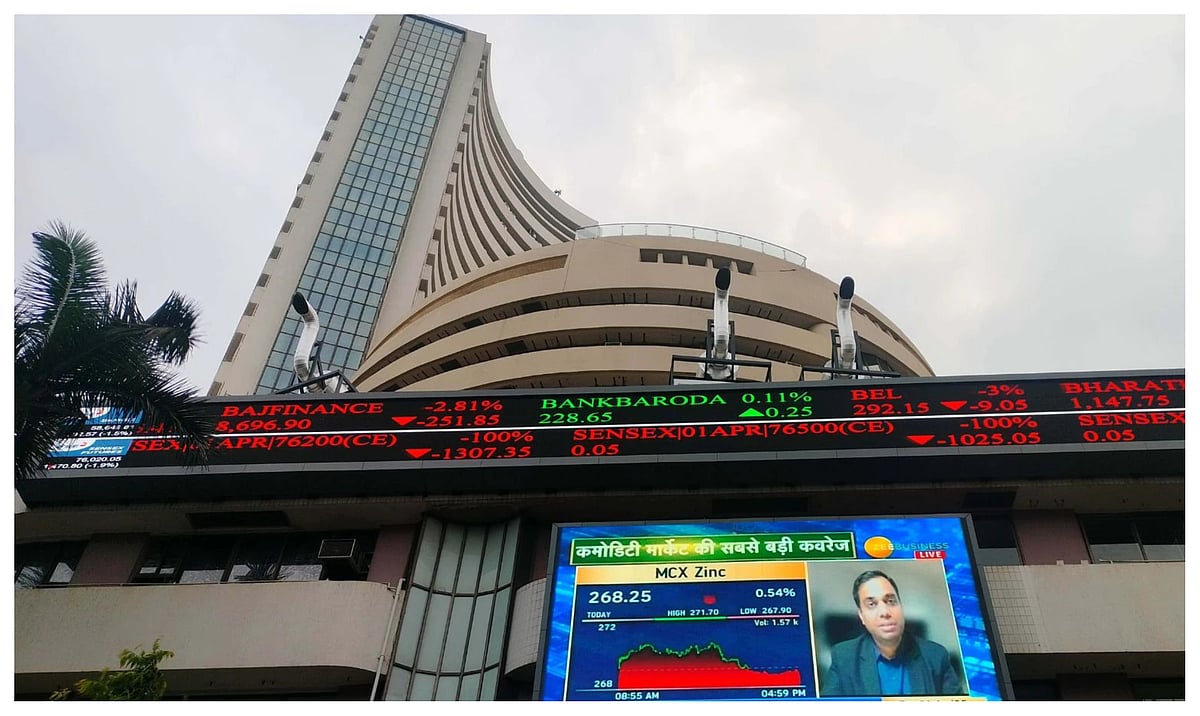

US Tariff Move Hits Indian Markets | File Image |

Mumbai: Indian stock markets witnessed a sharp decline in early trade on Tuesday, as rising global tensions and trade-related worries unsettled investors. The benchmark BSE Sensex fell 606.97 points or 0.74 percent to 81,028.94, while the NSE Nifty dropped 182.25 points or 0.73 percent to 24,785.50. This sudden fall comes just a day after both indices had closed in the green, highlighting the fragile mood among investors.

The key trigger behind the sell-off

The key trigger behind the sell-off was a draft notice issued by the United States announcing the implementation of an additional 25 percent tariff on Indian imports starting August 27. Although the move was officially linked to security threats posed by Russia, India has been included in the same policy action. This has raised serious concerns about the future of India’s exports to the US, which currently stand at around USD 86.5 billion.

Expert Views on market fall

According to experts, such high tariffs could make a large chunk of Indian exports commercially unviable, directly impacting several sectors and putting pressure on earnings. Prashanth Tapse, Senior VP at Mehta Equities, noted that this tariff move could become a major hurdle for Indian markets in the near term. The Reserve Bank of India, however, has responded by assuring policy intervention if the US tariff action begins to hurt domestic growth.

Weak cues from global markets adds to the negative mood

Adding to the negative mood were weak cues from global markets. Major Asian indices such as Japan’s Nikkei, South Korea’s Kospi, and Hong Kong’s Hang Seng were trading in the red, reflecting widespread concern over slowing global demand. Even crude oil prices slipped, with Brent crude down 0.48 percent at USD 68.47 per barrel.

ALSO READ

Selling pressure visible across sectors

On the domestic front, selling pressure was visible across sectors, with major companies like Sun Pharma, Tata Steel, ICICI Bank, HDFC Bank, and Tata Motors losing ground. Only defensive counters like Hindustan Unilever and tech major TCS managed to stay afloat in the red-dominated market.

ALSO READ

FIIs were net sellers

Adding further weight to the fall, Foreign Institutional Investors (FIIs) were net sellers, offloading Rs 2,466 crore worth of shares on Monday. Despite this, some analysts believe the market’s resilience could hold due to strong Domestic Institutional Investor (DII) buying. VK Vijayakumar of Geojit Investments said that even though earnings growth remains sluggish and valuations are high, DII support has helped prevent deeper corrections.

RECENT STORIES

-

-

-

-

-