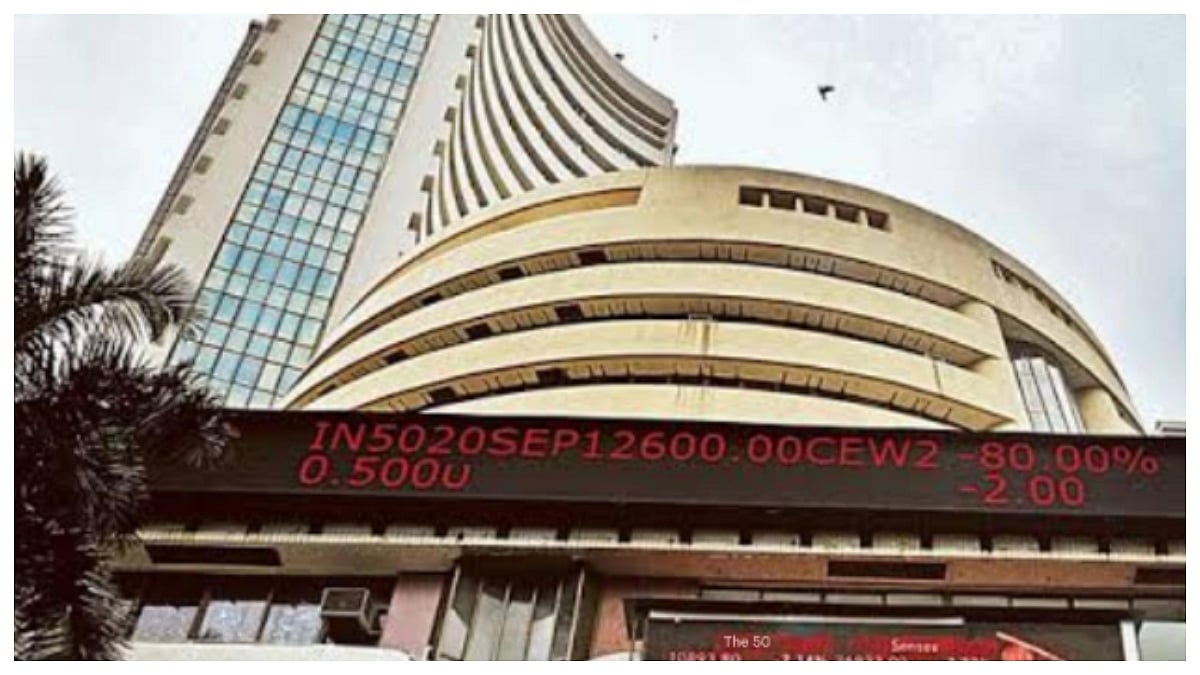

Sensex Falls 765 Points, Nifty Slips Below 24,400 Mark; Foreign Fund Outflow & Tariff Worries Drag Markets

Indian stock markets fell sharply on Friday as foreign investors pulled out money and worries over new US tariffs hurt investor confidence. Sensex and Nifty both dropped nearly 1 percent.

Markets End in the Red Amid Global Concerns. |

Mumbai: Indian stock markets closed sharply lower on Friday as foreign investors continued to sell heavily and nervousness grew over the impact of fresh US tariffs on Indian exports. Both key indices — the Sensex and Nifty — lost nearly 1 percent each, wiping out Thursday’s small gains.

The BSE Sensex crashed by 765.47 points to end the day at 79,857.79. During intraday trade, it had dropped even further, falling over 847 points to touch a low of 79,775.84. The broader NSE Nifty also declined sharply, closing 232.85 points lower at 24,363.30.

Heavy Selling by Foreign Investors

One of the key reasons for the market decline was the strong selling by Foreign Institutional Investors (FIIs). On Thursday alone, FIIs sold Indian stocks worth Rs 4,997.19 crore, according to stock exchange data. This continuous selling signals weakening foreign investor confidence, possibly due to fears over trade tensions and global economic uncertainty.

On the other hand, Domestic Institutional Investors (DIIs) remained buyers, purchasing stocks worth Rs 10,864.04 crore in the previous session. However, this domestic support wasn’t enough to stop Friday’s broad sell-off.

Tariff Jitters Add to Pressure

Investor mood turned more cautious after the US officially began implementing a 25 percent tariff on Indian goods starting Thursday. This move is expected to impact India’s exports and overall trade relationship with the US, creating uncertainty in the market.

Mixed Global Cues

Asian markets painted a mixed picture on Friday. Japan’s Nikkei 225 ended higher, while markets in South Korea, China (Shanghai Composite), and Hong Kong (Hang Seng) closed in the red. European stock markets, however, were mostly trading in positive territory, and US markets had ended Thursday on a mixed note.

Global oil prices also rose slightly, with Brent crude gaining 0.59 percent to reach USD 66.82 per barrel, which could further weigh on India’s import bill.

On Thursday, the markets had ended with minor gains. But Friday's slide has raised concerns over short-term volatility, especially amid rising global tensions and policy changes.

RECENT STORIES

-

-

-

-

-