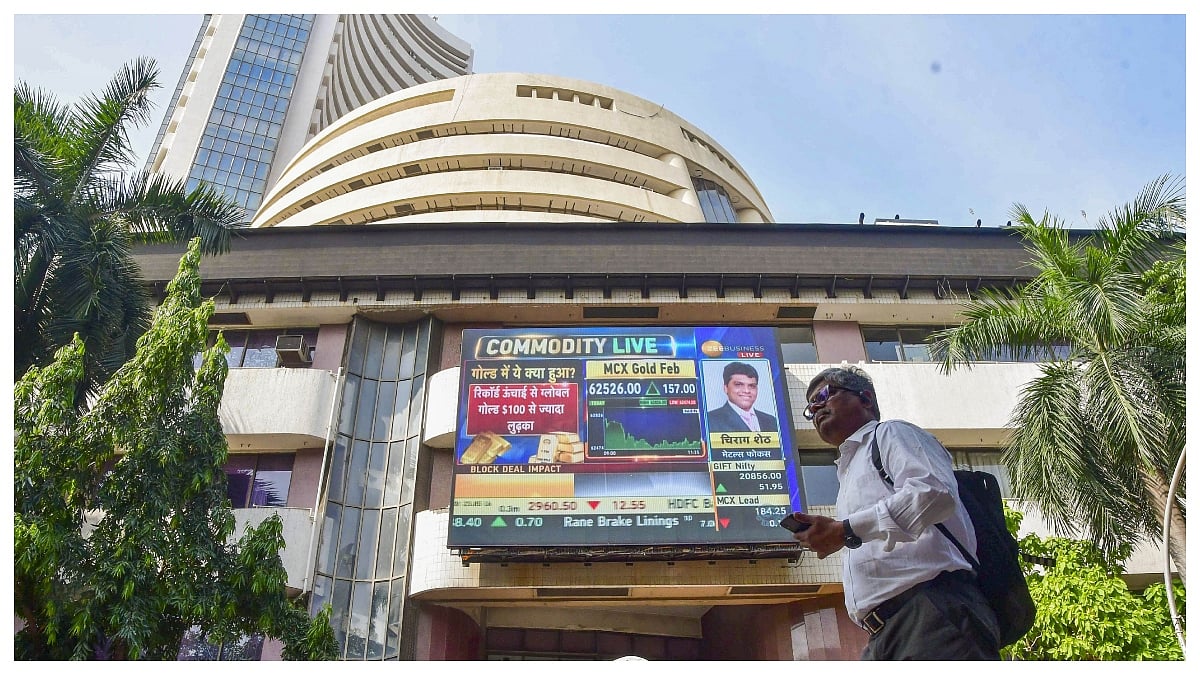

Mcap Of Six Top Firms Drops By ₹2.22 Lakh Crore, Reliance Leads Market Erosion Amid Bearish Trend

Market capitalisation of six of India’s top-10 most valued firms fell by Rs 2.22 lakh crore last week, led by Reliance Industries. Equity market weakness, foreign fund outflows, and global uncertainties impacted sentiment.

Top Firms See Rs 2.22 Lakh Crore Market Cap Wipeout. |

Mumbai: In a volatile trading week, the combined market capitalisation of six of India's top-10 most valued companies eroded by Rs 2.22 lakh crore. The losses were led by Reliance Industries, which alone accounted for over Rs 1.14 lakh crore in decline.

The benchmark BSE Sensex slipped by 294.64 points, or 0.36 percent, during the week, reflecting investor caution amid mixed earnings cues and broader macroeconomic uncertainties.

Reliance Industries Bears the Brunt

Reliance Industries saw its market valuation tumble by a massive Rs 1,14,687.7 crore, bringing its total mcap down to Rs 18,83,855.52 crore. Despite the dip, Reliance remains the most valuable listed company in India.

Other major losers included:

Infosys: Market cap down Rs 29,474.56 crore to Rs 6,29,621.56 crore

LIC: Dropped Rs 23,086.24 crore to Rs 5,60,742.67 crore

TCS: Declined Rs 20,080.39 crore to Rs 11,34,035.26 crore

Bajaj Finance: Fell Rs 17,524.3 crore to Rs 5,67,768.53 crore

Hindustan Unilever: Down Rs 17,339.98 crore to Rs 5,67,449.79 crore

Banking Majors Defy Downtrend

Contrary to the downtrend in many large-cap stocks, HDFC Bank, ICICI Bank, Bharti Airtel, and SBI posted gains in their market valuations, thanks to strong earnings and sustained investor confidence.

- HDFC Bank added Rs 37,161.53 crore, taking its valuation to Rs 15,38,078.95 crore.

- ICICI Bank gained Rs 35,814.41 crore, rising to Rs 10,53,823.14 crore.

- Bharti Airtel rose by Rs 20,841.2 crore to Rs 11,04,839.93 crore.

- State Bank of India advanced by Rs 9,685.34 crore to Rs 7,44,449.31 crore.

ALSO READ

Investor Sentiment Dampened by Global and Domestic Concerns

Market experts attributed the overall bearish tone to multiple factors, including:

- Mixed quarterly results

- Foreign portfolio outflows

- Uncertainty around global trade agreements

- Cooling optimism post-India-Pakistan border tensions

Ajit Mishra, SVP of Research at Religare Broking, noted that banking stocks provided some relief with strong earnings, but tech majors and consumer companies underperformed, adding to market volatility.

(With PTI Inputs)

RECENT STORIES

-

-

-

-

-