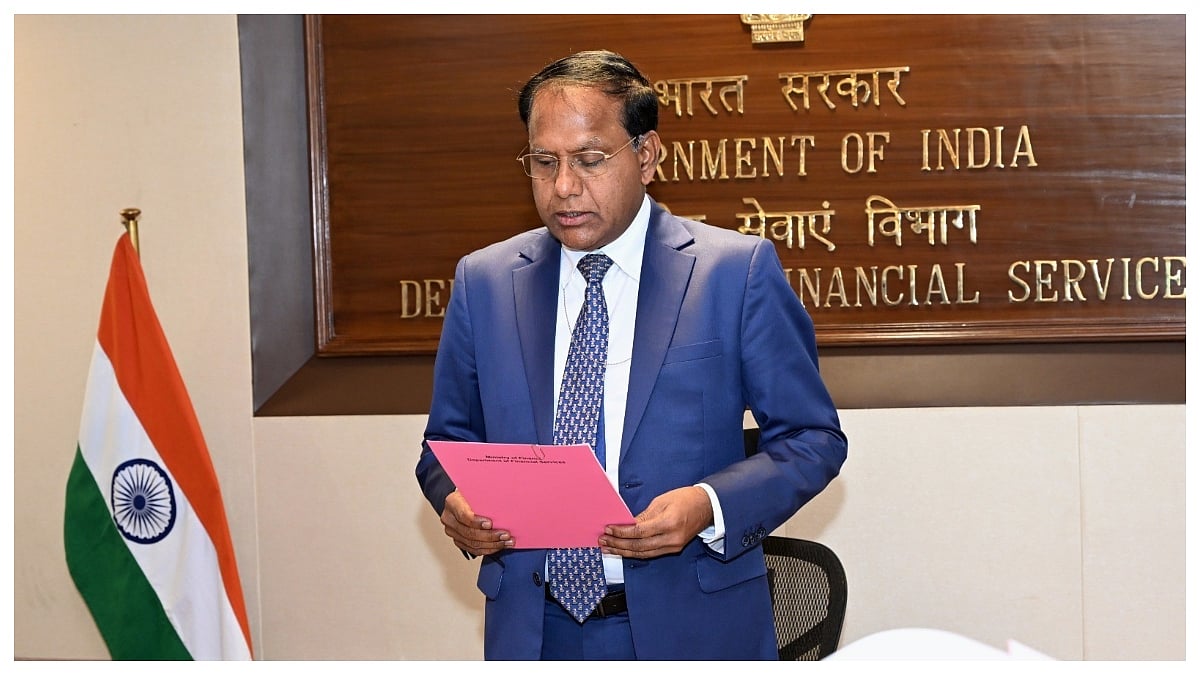

Financial Services Secretary M Nagaraju Urges MDs & CEOs Of State-Owned Banks To Increase Lending To Productive Sector

During the meeting, the secretary urged the MDs and CEOs of state-owned banks to increase lending towards the productive sector of the economy, according to sources.

File Image |

New Delhi: The finance ministry on Wednesday held a meeting of heads of public sector banks (PSBs) to review their first-quarter financial performance.The three-hour-long meeting was chaired by Financial Services Secretary M Nagaraju.During the meeting, the secretary urged the MDs and CEOs of state-owned banks to increase lending towards the productive sector of the economy, according to sources.

The review meeting with public sector banks assessed the performance of the first quarter of 2025-26.Led by State Bank of India (SBI), public sector banks, cumulatively, logged a record profit of Rs 44,218 crore in the first quarter of the current fiscal, with an 11 per cent year-on-year growth.All 12 public sector banks together made a profit of Rs 39,974 crore in the June quarter of FY25.

The increase in profit in absolute terms was Rs 4,244 crore.Market leader SBI alone contributed 43 per cent to the total earnings of Rs 44,218 crore, as per the published numbers on stock exchanges.SBI logged a net profit of Rs 19,160 crore in Q1 FY26, 12 per cent higher than the same period of the previous fiscal. In terms of size and profits, the biggest lender in the nation still controls the public banking market.

In percentage terms, Chennai-based Indian Overseas Bank reported the highest net profit growth of 76 per cent to Rs 1,111 crore, followed by Punjab & Sind Bank with a 48 per cent rise to Rs 269 crore.During the quarter, all 12 public sector banks (PSBs) except Punjab National Bank (PNB) reported a decline in profit.PNB reported a 48 per cent fall in net profit to Rs 1,675 crore against Rs 3,252 crore in the year-ago period.

Central Bank of India recorded 32.8 per cent growth in the June quarter net profit to Rs 1,169 crore, Indian Bank posted 23.7 per cent rise to Rs 2,973 crore, and Bank of Maharashtra logged 23.2 per cent improvement to Rs 1,593 crore.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.

RECENT STORIES

-

-

-

-

-