Adani Power Hits Upper Circuit After 1:5 Stock Split, Retail Buzz & SEBI Clean Chit Fuel Strong Rally

Adani Power shares jumped 19.98 percent after a 1:5 stock split and a clean regulatory record post-Hindenburg claims. Lower share price aims to attract retail investors and boost liquidity.

Stock Jumps 19.98 percent After Split Becomes Effective. |

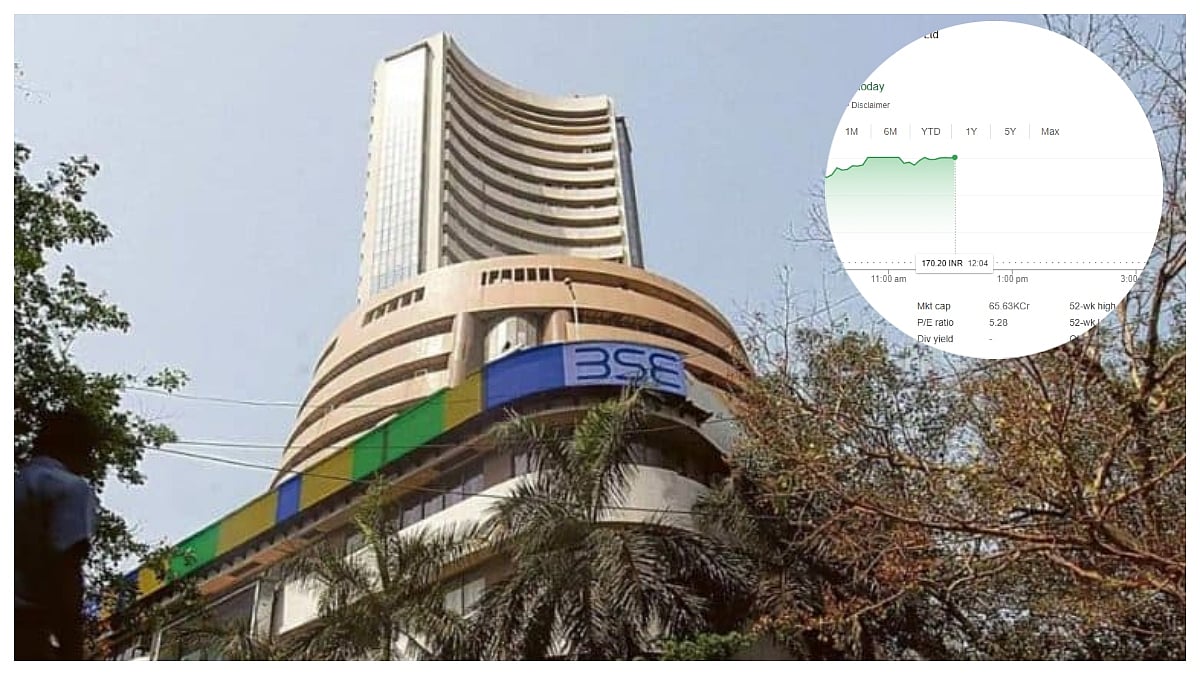

Mumbai: Adani Power shares surged 20 percent percent on Monday after the company’s stock split became effective. The stock touched a high of Rs 168.50 on the BSE, adjusted to the new face value. On an unadjusted basis, the share opened at Rs 141.80, sharply down from Rs 709.05 — but that’s due to the 1:5 stock split, where each share of Rs 10 was divided into five shares of Rs 2 each.

What Is a Stock Split?

A stock split divides existing shares into smaller parts to make them more affordable. In Adani Power’s case, one share has now become five, with the face value reduced from Rs 10 to Rs 2. This doesn’t affect the company’s overall value but makes the stock more accessible to small investors, increasing market participation and trading liquidity.

After the split, the company’s total number of paid-up shares has increased from about 385 crore to over 1,928 crore. However, the total share capital remains the same. This move is different from a bonus issue, where shareholders get free shares but the face value remains unchanged.

Clean Chit from SEBI Boosts Sentiment

Another major reason behind the stock rally is SEBI's recent conclusion regarding the Hindenburg allegations. SEBI said the claims of fund misuse and manipulation involving firms like Adicorp and Milestone were not proven. Though related-party dealings existed, they were properly disclosed. This regulatory clarity has brought relief to investors and lifted confidence in Adani Group stocks.

Analyst Support Adds to Momentum

Adding to the positive sentiment, Morgan Stanley recently initiated coverage on Adani Power. The global investment firm called it a top pick, highlighting its turnaround story, regulatory clarity, and growth potential from new projects and power deals.

With strong momentum, positive news, and increased accessibility, Adani Power has become one of the most-watched stocks in the market right now.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult a certified financial advisor before making any investment or trading decisions in the stock market.

RECENT STORIES

-

-

-

-

-